“Market conditions are changing. The continued rise in interest rates suggests we are in the early stages of a bond bear market, which could intensify as central banks withdraw liquidity. The receding tide of liquidity will start to reveal more rocks beyond what has been exposed in emerging markets so far, and the value of a value discipline will be in avoiding the biggest capital-destroying rocks. If a rock emerges on the crowded shore of U.S. momentum, it could result in a major liquidity challenge, as momentum is often most intense on the downside as a crowded trade reverses. So investors are facing a large potential trade-off right now: continue to bet on the current dominance of momentum and the S&P 500, or bet on change and take an active value bet in names with attractive value and optionality, but with negative momentum,” said Clearbridge Investments in its market commentary. We aren’t sure whether long-term interest rates will top 5% and value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Apache Corporation (NYSE:APA).

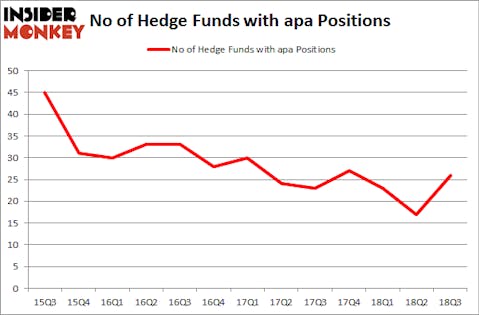

Is Apache Corporation (NYSE:APA) ready to rally soon? The smart money is turning bullish. The number of long hedge fund bets advanced by 9 recently. Our calculations also showed that apa isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the recent hedge fund action regarding Apache Corporation (NYSE:APA).

Hedge fund activity in Apache Corporation (NYSE:APA)

Heading into the fourth quarter of 2018, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 53% from the previous quarter. On the other hand, there were a total of 27 hedge funds with a bullish position in APA at the beginning of this year. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Orbis Investment Management, managed by William B. Gray, holds the largest position in Apache Corporation (NYSE:APA). Orbis Investment Management has a $748.9 million position in the stock, comprising 4.3% of its 13F portfolio. The second most bullish fund manager is Ken Griffin of Citadel Investment Group, with a $31.6 million call position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions comprise Ken Griffin’s Citadel Investment Group, John Overdeck and David Siegel’s Two Sigma Advisors and Steve Cohen’s Point72 Asset Management.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Millennium Management, managed by Israel Englander, created the biggest position in Apache Corporation (NYSE:APA). Millennium Management had $4.2 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also made a $3.8 million investment in the stock during the quarter. The following funds were also among the new APA investors: Matthew Tewksbury’s Stevens Capital Management, Paul Tudor Jones’s Tudor Investment Corp, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

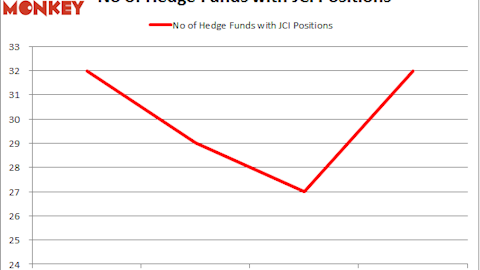

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Apache Corporation (NYSE:APA) but similarly valued. These stocks are Plains All American Pipeline, L.P. (NYSE:PAA), FirstEnergy Corp. (NYSE:FE), IAC/InterActiveCorp (NASDAQ:IAC), and Total System Services, Inc. (NYSE:TSS). This group of stocks’ market caps match APA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAA | 10 | 49421 | 0 |

| FE | 38 | 3701409 | 10 |

| IAC | 51 | 3125902 | 0 |

| TSS | 35 | 1383994 | 6 |

| Average | 33.5 | 2065182 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.5 hedge funds with bullish positions and the average amount invested in these stocks was $2.07 billion. That figure was $882 million in APA’s case. IAC/InterActiveCorp (NASDAQ:IAC) is the most popular stock in this table. On the other hand Plains All American Pipeline, L.P. (NYSE:PAA) is the least popular one with only 10 bullish hedge fund positions. Apache Corporation (NYSE:APA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard IAC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.