We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Amkor Technology, Inc. (NASDAQ:AMKR).

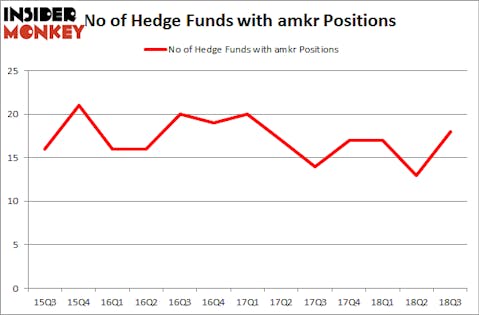

Amkor Technology, Inc. (NASDAQ:AMKR) has experienced an increase in hedge fund sentiment lately. AMKR was in 18 hedge funds’ portfolios at the end of September. There were 13 hedge funds in our database with AMKR holdings at the end of the previous quarter. Our calculations also showed that amkr isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Cliff Asness of AQR Capital Management

We’re going to go over the latest hedge fund action regarding Amkor Technology, Inc. (NASDAQ:AMKR).

How are hedge funds trading Amkor Technology, Inc. (NASDAQ:AMKR)?

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 38% from the previous quarter. On the other hand, there were a total of 17 hedge funds with a bullish position in AMKR at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, D. E. Shaw’s D E Shaw has the most valuable position in Amkor Technology, Inc. (NASDAQ:AMKR), worth close to $17.1 million, corresponding to less than 0.1%% of its total 13F portfolio. Sitting at the No. 2 spot is Cliff Asness of AQR Capital Management, with a $8.7 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish consist of John Overdeck and David Siegel’s Two Sigma Advisors, Jim Simons’s Renaissance Technologies and Ken Griffin’s Citadel Investment Group.

As industrywide interest jumped, key money managers have been driving this bullishness. GLG Partners, managed by Noam Gottesman, created the most outsized position in Amkor Technology, Inc. (NASDAQ:AMKR). GLG Partners had $0.4 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $0.2 million investment in the stock during the quarter. The following funds were also among the new AMKR investors: Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, David Costen Haley’s HBK Investments, and George Zweig, Shane Haas and Ravi Chander’s Signition LP.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Amkor Technology, Inc. (NASDAQ:AMKR) but similarly valued. We will take a look at Gazit Globe Ltd. (NYSE:GZT), Invesco Mortgage Capital Inc (NYSE:IVR), Magellan Health Inc (NASDAQ:MGLN), and Masonite International Corp (NYSE:DOOR). This group of stocks’ market caps are closest to AMKR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GZT | 4 | 15617 | 0 |

| IVR | 11 | 14431 | -3 |

| MGLN | 20 | 248083 | -1 |

| DOOR | 21 | 338851 | 5 |

| Average | 14 | 154246 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $154 million. That figure was $48 million in AMKR’s case. Masonite International Corp (NYSE:DOOR) is the most popular stock in this table. On the other hand Gazit Globe Ltd. (NYSE:GZT) is the least popular one with only 4 bullish hedge fund positions. Amkor Technology, Inc. (NASDAQ:AMKR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard DOOR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.