Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

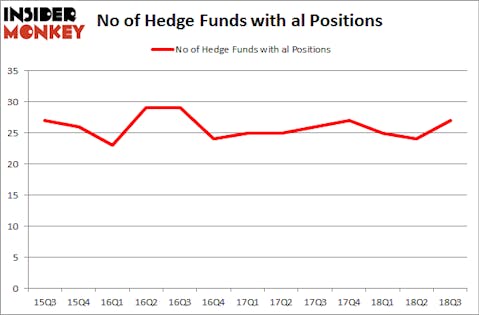

Is Air Lease Corp (NYSE:AL) the right investment to pursue these days? Prominent investors are buying. The number of bullish hedge fund bets inched up by 3 in recent months. Our calculations also showed that al isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to review the key hedge fund action regarding Air Lease Corp (NYSE:AL).

How have hedgies been trading Air Lease Corp (NYSE:AL)?

At the end of the third quarter, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from one quarter earlier. By comparison, 27 hedge funds held shares or bullish call options in AL heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Chuck Royce’s Royce & Associates has the most valuable position in Air Lease Corp (NYSE:AL), worth close to $117.7 million, accounting for 0.8% of its total 13F portfolio. The second most bullish fund manager is Ken Griffin of Citadel Investment Group, with a $53.2 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism contain Matthew Lindenbaum’s Basswood Capital, Cliff Asness’s AQR Capital Management and Bernard Selz’s Selz Capital.

Now, key hedge funds have been driving this bullishness. Alyeska Investment Group, managed by Anand Parekh, established the most valuable position in Air Lease Corp (NYSE:AL). Alyeska Investment Group had $7.2 million invested in the company at the end of the quarter. Wayne Cooperman’s Cobalt Capital Management also initiated a $2 million position during the quarter. The other funds with new positions in the stock are Noam Gottesman’s GLG Partners, Roger Ibbotson’s Zebra Capital Management, and Frederick DiSanto’s Ancora Advisors.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Air Lease Corp (NYSE:AL) but similarly valued. We will take a look at Conduent Incorporated (NYSE:CNDT), 51job, Inc. (NASDAQ:JOBS), Hospitality Properties Trust (NYSE:HPT), and YY Inc (NASDAQ:YY). This group of stocks’ market valuations resemble AL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNDT | 34 | 1156262 | 2 |

| JOBS | 14 | 45623 | 2 |

| HPT | 16 | 86991 | 0 |

| YY | 25 | 201060 | 4 |

| Average | 22.25 | 372484 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $372 million. That figure was $428 million in AL’s case. Conduent Incorporated (NYSE:CNDT) is the most popular stock in this table. On the other hand 51job, Inc. (NASDAQ:JOBS) is the least popular one with only 14 bullish hedge fund positions. Air Lease Corp (NYSE:AL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CNDT might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.