Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

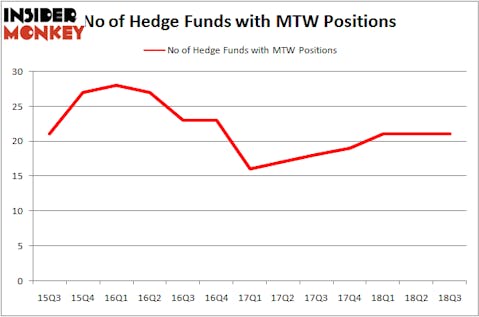

The Manitowoc Company, Inc. (NYSE:MTW) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 21 hedge funds’ portfolios at the end of the third quarter of 2018. At the end of this article we will also compare MTW to other stocks including ORBCOMM Inc (NASDAQ:ORBC), CBRE Clarion Global Real Estate Income Fund (NYSE:IGR), and Monotype Imaging Holdings Inc. (NASDAQ:TYPE) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the recent hedge fund action encompassing The Manitowoc Company, Inc. (NYSE:MTW).

How are hedge funds trading The Manitowoc Company, Inc. (NYSE:MTW)?

At Q3’s end, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, no change from the second quarter of 2018. On the other hand, there were a total of 19 hedge funds with a bullish position in MTW at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Firefly Value Partners held the most valuable stake in The Manitowoc Company, Inc. (NYSE:MTW), which was worth $67.8 million at the end of the third quarter. On the second spot was Icahn Capital LP which amassed $40.4 million worth of shares. Moreover, Southpoint Capital Advisors, Rutabaga Capital Management, and Citadel Investment Group were also bullish on The Manitowoc Company, Inc. (NYSE:MTW), allocating a large percentage of their portfolios to this stock.

Because The Manitowoc Company, Inc. (NYSE:MTW) has faced a decline in interest from the aggregate hedge fund industry, logic holds that there exists a select few funds that slashed their full holdings by the end of the third quarter. Interestingly, John Overdeck and David Siegel’s Two Sigma Advisors dumped the largest position of the “upper crust” of funds watched by Insider Monkey, comprising about $2.9 million in stock, and Jim Simons’s Renaissance Technologies was right behind this move, as the fund cut about $2.2 million worth. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to The Manitowoc Company, Inc. (NYSE:MTW). We will take a look at ORBCOMM Inc (NASDAQ:ORBC), CBRE Clarion Global Real Estate Income Fund (NYSE:IGR), Monotype Imaging Holdings Inc. (NASDAQ:TYPE), and Calamos Convertible Opportunities and Income Fund (NASDAQ:CHI). All of these stocks’ market caps match MTW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ORBC | 15 | 129651 | 0 |

| IGR | 2 | 444 | -1 |

| TYPE | 18 | 203680 | 2 |

| CHI | 1 | 124 | 0 |

| Average | 9 | 83475 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $83 million. That figure was $204 million in MTW’s case. Monotype Imaging Holdings Inc. (NASDAQ:TYPE) is the most popular stock in this table. On the other hand Calamos Convertible Opportunities and Income Fund (NASDAQ:CHI) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks The Manitowoc Company, Inc. (NYSE:MTW) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.