Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth depends on it. Regardless of the various methods used by elite investors like David Tepper and Dan Loeb, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

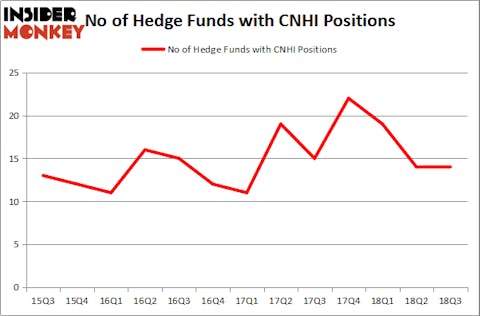

CNH Industrial NV (NYSE:CNHI) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 14 hedge funds’ portfolios at the end of the third quarter of 2018. At the end of this article we will also compare CNHI to other stocks including Weibo Corp (NASDAQ:WB), Nomura Holdings, Inc. (NYSE:NMR), and Skyworks Solutions Inc (NASDAQ:SWKS) to get a better sense of its popularity.

If you’d ask most traders, hedge funds are perceived as unimportant, old investment vehicles of yesteryear. While there are greater than 8000 funds trading at present, We hone in on the top tier of this club, around 700 funds. These money managers handle most of the smart money’s total capital, and by tailing their unrivaled stock picks, Insider Monkey has uncovered various investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s view the recent hedge fund action regarding CNH Industrial NV (NYSE:CNHI).

What does the smart money think about CNH Industrial NV (NYSE:CNHI)?

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, there was no change from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CNHI over the last 13 quarters. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Among these funds, GAMCO Investors held the most valuable stake in CNH Industrial NV (NYSE:CNHI), which was worth $153.1 million at the end of the third quarter. On the second spot was Southeastern Asset Management, which amassed $140.2 million worth of shares. Moreover, Citadel Investment Group, Renaissance Technologies, and AQR Capital Management were also bullish on CNH Industrial NV (NYSE:CNHI), allocating a large percentage of their portfolios to this stock.

Seeing as CNH Industrial NV (NYSE:CNHI) has witnessed declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there lies a certain “tier” of hedge funds that elected to cut their full holdings last quarter. Interestingly, Louis Navellier’s Navellier & Associates dropped the largest investment of the “upper crust” of funds monitored by Insider Monkey, comprising close to $3.4 million in stock. Matthew Tewksbury’s fund, Stevens Capital Management, also dropped its stock, about $1.8 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as CNH Industrial NV (NYSE:CNHI) but similarly valued. We will take a look at Weibo Corp (NASDAQ:WB), Nomura Holdings, Inc. (NYSE:NMR), Skyworks Solutions Inc (NASDAQ:SWKS), and Smith & Nephew plc (NYSE:SNN). This group of stocks’ market caps match CNHI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WB | 23 | 289445 | 3 |

| NMR | 2 | 38756 | -2 |

| SWKS | 25 | 1037653 | -2 |

| SNN | 9 | 307918 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $418 million. That figure was $342 million in CNHI’s case. Skyworks Solutions Inc (NASDAQ:SWKS) is the most popular stock in this table. On the other hand Nomura Holdings, Inc. (NYSE:NMR) is the least popular one with only 2 bullish hedge fund positions. CNH Industrial NV (NYSE:CNHI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SWKS might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.