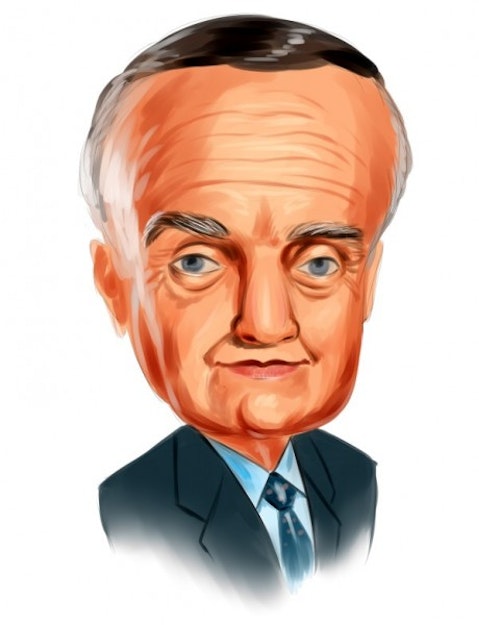

Leon Cooperman On Insider Trading Charges: ‘We Acted Appropriately And Lawfully’ (CNBC)

Billionaire hedge fund titan Leon Cooperman told CNBC on Tuesday he won’t enter a deal with regulators to settle insider trading charges and he insisted he has always followed the law. In a statement he gave to CNBC before his appearance on “Squawk Box,” Cooperman said: “We could have settled this matter with the SEC for an amount that is far less than I donate to charity every year. But I refused to do so because I know that we acted appropriately and lawfully.” The Omega Advisors chairman and CEO also said: “It took me 50 years of very hard work, long hours and playing by the rules to get where I am professionally, and I’m not going to let my legacy be destroyed unfairly.”

Renaissance Technologies: Hedge Fund on a $7 Billion Winning Streak (The Wall Street Journal)

Many hedge funds and mutual funds are slashing fees, laying off employees and losing customers following years of subpar performance. Then there is Renaissance Technologies LLC. The hedge-fund firm, which relies on closely held computer models and algorithms, has staged a comeback after an uneven spell, with its funds posting market-beating gains for more than the past year. Now they are getting a cash influx, even as rivals suffer withdrawals. Renaissance attracted more than $7 billion in new investor money over the past year from wealthy clients of UBS Group AG, Citigroup Inc. and others, according to people close to the matter.

Buffalo Wild Wings Ignores Marcato, Adds Three New Directors (Reuters)

Restaurant operator Buffalo Wild Wings Inc named three independent directors to its board, ignoring activist hedge fund Marcato Capital Management‘s offer of a nominee. The company said on Tuesday it appointed Andre Fernandez, Hal Lawton and Harmit Singh, expanding its board to nine from eight directors. Marcato, which holds a 5.2 percent stake in Buffalo Wild Wings, said in August that it would be “inappropriate” to add new directors without consulting its major shareholders and offered a “senior” Marcato executive to serve on the company’s board.

Citadel, Millennium Staging Comeback to Reverse Losses for 2016 (Bloomberg)

How the mighty have fallen — and gotten back up. In a year marked by poor performance among many major hedge funds, managers from Citadel to Millennium are on the upswing. After falling 5 percent in February and losing money in June and July, New York-based Coatue Management’s offshore fund rose 2.3 percent in September, according to a document obtained by Bloomberg. The $10 billion firm, run by Philippe Laffont and known for betting on technology companies such as PayPal Holdings Inc., gained 1.9 percent in the fund for the first nine months of 2016.

Citadel Hires Top UBS ETF Trader Kirk (Reuters)

Citadel Securities LLC said on Tuesday it has hired Haddon Kirk, who has been head of exchange-traded funds trading for UBS AG’s U.S. investment bank. Kirk is joining Citadel in a senior role focused on massive “block” trades of the funds, a company executive told Reuters. He starts Oct 31. The company’s securities dealing division says it trades 18 percent of U.S. ETFs by share volume. Many such trades are negotiated and conducted in private. The Chicago-based company, run by Kenneth Griffin, is also known for its hedge fund.

U.S. Hedge Fund Files Lawsuit Accusing Theranos of Fraud (Reuters)

A San Francisco-based hedge fund has filed a lawsuit against Theranos Inc, accusing the blood testing company of using fraudulent methods to attract an investment of nearly $100 million, according to an investor letter filed by the fund. The hedge fund, Partner Fund Management LP, filed the lawsuit in the Delaware Court of Chancery on Monday afternoon, a letter to the hedge fund’s investors said. “Through a series of lies, material misstatements, and omissions, the defendants engaged in securities fraud and other violations by fraudulently inducing PFM to invest and maintain its investment in the company,” said the letter, which was reviewed by Reuters.

Dalio’s Bridgewater Funds Rose Across Strategies Last Month (Bloomberg)

Ray Dalio’s $150 billion Bridgewater Associates gained across its main strategies last month, trimming losses in its Pure Alpha macro hedge funds and extending a rally in the company’s long-only All Weather fund, according to a person with knowledge of the matter. Bridgewater’s Pure Alpha II, which has the majority of the assets in the firm’s hedge-fund strategy, gained 0.5 percent in September, reducing this year’s decline to 10.3 percent, said the person, who asked not to be identified because the information is private. Pure Alpha I, which targets lower volatility than the Pure Alpha II version, rose 0.3 percent for the month and pared losses through Sept. 30 to 6.7 percent.