Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ complex research processes to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space. Nevertheless, it is also possible to find underpriced large-cap stocks by following the hedge funds’ moves. In this article, we look at what those funds think of Evercore Inc. (NYSE:EVR) based on that data.

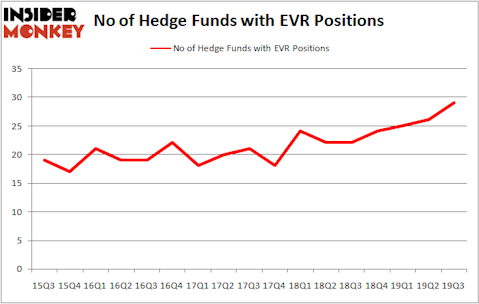

Is Evercore Inc. (NYSE:EVR) worth your attention right now? Prominent investors are becoming hopeful. The number of long hedge fund bets inched up by 3 in recent months. Our calculations also showed that EVR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings). EVR was in 29 hedge funds’ portfolios at the end of September. There were 26 hedge funds in our database with EVR positions at the end of the previous quarter.

To the average investor there are many gauges shareholders can use to analyze stocks. Two of the less utilized gauges are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the elite fund managers can trounce the market by a significant margin (see the details here).

Steven Cohen of Point72 Asset Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Keeping this in mind let’s take a look at the new hedge fund action surrounding Evercore Inc. (NYSE:EVR).

How have hedgies been trading Evercore Inc. (NYSE:EVR)?

At the end of the third quarter, a total of 29 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 12% from one quarter earlier. By comparison, 22 hedge funds held shares or bullish call options in EVR a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Citadel Investment Group held the most valuable stake in Evercore Inc. (NYSE:EVR), which was worth $102.4 million at the end of the third quarter. On the second spot was Millennium Management which amassed $78.9 million worth of shares. Point72 Asset Management, GLG Partners, and Fisher Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Azora Capital allocated the biggest weight to Evercore Inc. (NYSE:EVR), around 1.07% of its 13F portfolio. Buckingham Capital Management is also relatively very bullish on the stock, designating 0.57 percent of its 13F equity portfolio to EVR.

With a general bullishness amongst the heavyweights, specific money managers were leading the bulls’ herd. Royce & Associates, managed by Chuck Royce, established the most valuable position in Evercore Inc. (NYSE:EVR). Royce & Associates had $9.1 million invested in the company at the end of the quarter. Gregg Moskowitz’s Interval Partners also initiated a $3.8 million position during the quarter. The following funds were also among the new EVR investors: George Soros’s Soros Fund Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Benjamin A. Smith’s Laurion Capital Management.

Let’s go over hedge fund activity in other stocks similar to Evercore Inc. (NYSE:EVR). These stocks are RH (NYSE:RH), Brookfield Business Partners L.P. (NYSE:BBU), Community Bank System, Inc. (NYSE:CBU), and Watts Water Technologies Inc (NYSE:WTS). All of these stocks’ market caps match EVR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RH | 32 | 876978 | 4 |

| BBU | 6 | 10495 | 1 |

| CBU | 13 | 23777 | 1 |

| WTS | 22 | 266224 | 7 |

| Average | 18.25 | 294369 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $294 million. That figure was $340 million in EVR’s case. RH (NYSE:RH) is the most popular stock in this table. On the other hand Brookfield Business Partners L.P. (NYSE:BBU) is the least popular one with only 6 bullish hedge fund positions. Evercore Inc. (NYSE:EVR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately EVR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on EVR were disappointed as the stock returned 7.4% in 2019 and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.