U.S. Hedge Fund Farallon Accuses Toshiba of ‘Backpedaling’ on Strategy (Reuters)

TOKYO (Reuters) – Farallon Capital Management on Tuesday accused Toshiba Corp on Tuesday of “backpedaling” over its investment strategy, a charge the Japanese firm has dismissed. Farallon, Toshiba’s second largest shareholder, has called for an extraordinary meeting to seek shareholders’ approval over what the fund had said is the Japanese firm’s shift towards large-scale mergers and acquisitions.

Philip Falcone’s Second Act in Long-Term-Care Insurance Turns Ugly (The Wall Street Journal)

Long-term care has been a troubled insurance product for well over a decade, causing financial pain to many insurers and their customers. Now, one executive’s plan to make money where others have failed has backfired. Serious pricing mistakes loomed from the start. For policyholders, this has meant double- and even triple-digit premium-rate increases over the years. Insurers have collectively taken tens of billions of dollars of charges against earnings as they bolstered their reserves.

Picton Hedge Fund Shorts Junk Debt as Yields Pinch Safety Margin (Bloomberg)

Hedge fund manager Picton Mahoney Asset Management is shorting U.S. junk bonds as part of a defensive fixed-income strategy after historically low yields have left investors with few safeguards. U.S. junk-rated bond sales have swelled to record levels so far this year as companies lock in lower borrowing costs amid falling yields, which last month dipped below 4% for the first time ever. Despite the recent increase in government bond yields, financing costs for firms rated high yield remain at historically low levels.

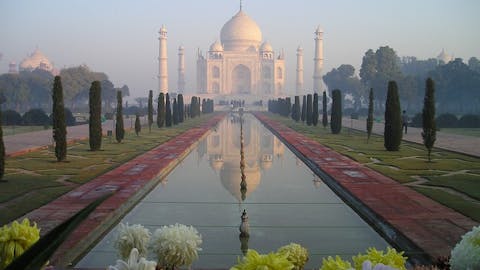

Maxx-Studio/Shutterstock.com

Odey’s Hedge Fund Hits Three-Decade High as Sexual Assault Trial Rumbles on in the Background (City A.M.)

Crispin Odey’s hedge fund enjoyed record gains last month, as his highly-leveraged bets against government bonds paid off. The Odey European Inc. fund surged 38.4 per cent in February – the best monthly return in almost three decades of trading, according to an investor update seen by Bloomberg. The performance lifted this year’s gains to 51 per cent – a rare bright spot for a fund that’s suffered losses in five of the past six years. The news comes as Odey faces sexual assault allegations that date back more than 20 years.

Based on Bill Ackman’s Tweets, Pershing Square Tontine Could Be Ready to Move (InvestorPlace.com)

Everybody loves special purpose acquisition companies (SPAC’s) nowadays, right? Okay, not everybody does, but they’ve made a lot of money for some investors. One particularly buzz-worthy one is Pershing Square Tontine Holdings (NYSE:PSTH), and the holders of PSTH stock are undoubtedly hoping for some big news. Perhaps they’re anticipating the sizable price moves that they witnessed in other SPAC stocks. One example would be Landcandia Holdings II, which formerly traded under the symbol LCA and morphed into Golden Nugget Online Gaming (NASDAQ:GNOG) stock.

Dan Loeb Is the Latest Billionaire to Dive Into the World of Crypto (Bloomberg)

Another week, another billionaire weighing in on cryptocurrency. On Monday it was hedge-fund billionaire Dan Loeb, who took to Twitter to share his thoughts on the subject. “I’ve been doing a deep dive into crypto lately,” he said. “It is a real test of being intellectually open to new and controversial ideas.” Cryptocurrencies aren’t exactly new, but digital coins such as Bitcoin have been the subject of great controversy alright.

Announcing: Nominations for 2020 Nordic Hedge Award (Hedge Nordic)

Stockholm (HedgeNordic) – HedgeNordic is delighted to announce the nominees for the 2020 Nordic Hedge Award. The annual distinction recognizes the best Nordic hedge funds. Nominees were selected using a quantitative model co-developed with the Stockholm School of Economics. The model translates several of each fund’s performance-related metrics into points, with these metrics including last year’s absolute performance, relative performance in 2020 (respective to relevant NHX sub-categories), Sharpe ratio over the past 36 months, absolute performance over the past 36 months, and skewness over the same period.

Hedge Fund Giant Man Group Sees Funds Under Management Hit Record High as Alternative Strategies Rise (Hedge Week)

Man Group, the publicly-quoted London-headquartered global hedge fund group, has seen its funds under management hit record highs, with its hedge funds and alternative strategies posting strong performances amid 2020’s unprecedented coronavirus-fuelled turbulence, despite a fall in annual pre-tax profits for the company. The FTSE250-listed group’s funds under management surged to a new high of USD123.6 billion last year – a USD5.9 billion rise from the USD117.7 billion recorded at the end of 2019.

How the COVID-19 Disruption Is Improving Fundraising Processes (Preqin)

How does a people business continue to function in a world where people cannot meet? For many GPs, engagement and dialogue with current and prospective LPs accelerated in the first quarter of 2020. This was true across all alternative asset classes, but nowhere was it more vital than in infrastructure. Investors were attracted to the sector’s defensive characteristics and many areas – such as ports, airports, roads, and energy – were perceived as having guaranteed demand and had been financed accordingly.

City Hedge Fund Manager’s Suicide Indicative of Wider Sector Covid Stress (Financial News)

A hedge fund manager who took his own life last year was experiencing high stress amid a tough time for the business, in a sign of the pain being felt across financial services during the pandemic. Former Polar Capital fund manager Guy Rushton, 36, was found dead last May following his discharge from a psychiatric hospital. His death was attributed to “high stress” from being unable to take time off at work and anxiety about the future of the fund he managed, his widow said, particularly “about the value of his own money invested…

Tuesday 3/2 Insider Buying Report: LOW, SATS (Nasdaq.com)

At Lowe’s Companies, a filing with the SEC revealed that on Friday, Director David H. Batchelder purchased 6,250 shares of LOW, for a cost of $159.48 each, for a total investment of $996,755. So far Batchelder is in the green, up about 3.3% on their buy based on today’s trading high of $164.75. Lowe’s Companies is trading up about 1.2% on the day Tuesday. And on Thursday, CSO & President – ESS Anders N. Johnson bought $469,000 worth of EchoStar, buying 20,000 shares at a cost of $23.45 each. EchoStar is trading up about 6.4% on the day Tuesday. So far Johnson is in the green, up about 6.8% on their purchase based on today’s trading high of $25.05.

Roku Inc (ROKU) CEO and Chairman BOD Anthony J. Wood Sold $18.5 million of Shares (Guru Focus)

CEO and Chairman BOD of Roku Inc, Anthony J. Wood, sold 45,000 shares of ROKU on 03/01/2021 at an average price of $411.67 a share. The total sale was $18.5 million. Roku Inc operates TV streaming platform in the United States. Its TV streaming platform allows users to discover and access a variety of movies and TV episodes, as well as live sports, music, news and more.