Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Central Garden & Pet Co (NASDAQ:CENT) from the perspective of those elite funds.

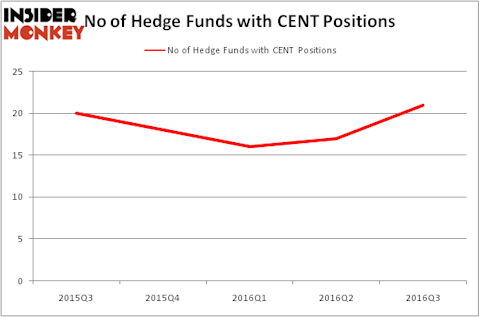

Is Central Garden & Pet Co (NASDAQ:CENT) a healthy stock for your portfolio? The smart money is taking a bullish view. The number of long hedge fund positions increased by 4 in recent months. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as MSG Networks Inc (NYSE:MSGN), Express, Inc. (NYSE:EXPR), and Seres Therapeutics Inc (NASDAQ:MCRB) to gather more data points.

Follow Central Garden & Pet Co (NASDAQ:CENT)

Follow Central Garden & Pet Co (NASDAQ:CENT)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

How are hedge funds trading Central Garden & Pet Co (NASDAQ:CENT)?

Heading into the fourth quarter of 2016, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 24% jump from one quarter earlier, pushing hedgie ownership of the stock to a yearly high. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Jim Simons’ Renaissance Technologies has the most valuable position in Central Garden & Pet Co (NASDAQ:CENT), worth close to $20.1 million. Remaining peers that are bullish contain Peter Schliemann’s Rutabaga Capital Management, Cliff Asness’ AQR Capital Management and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.