Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Grupo Televisa SAB (NYSE:TV), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

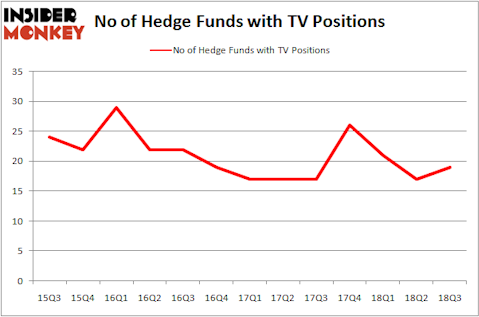

Grupo Televisa SAB (NYSE:TV) shareholders have witnessed an increase in activity from the world’s largest hedge funds lately. TV was in 19 hedge funds’ portfolios at the end of September. There were 17 hedge funds in our database with TV holdings at the end of the previous quarter. Our calculations also showed that TV isn’t among the 30 most popular stocks among hedge funds.

According to most stock holders, hedge funds are perceived as slow, outdated financial vehicles of yesteryear. While there are greater than 8,000 funds trading at the moment, Our experts hone in on the top tier of this club, about 700 funds. Most estimates calculate that this group of people watch over the majority of the smart money’s total asset base, and by monitoring their inimitable picks, Insider Monkey has deciphered a few investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a peek at the fresh hedge fund action regarding Grupo Televisa SAB (NYSE:TV).

What does the smart money think about Grupo Televisa SAB (NYSE:TV)?

At the end of the third quarter, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 12% from one quarter earlier. By comparison, 26 hedge funds held shares or bullish call options in TV heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, FPR Partners held the most valuable stake in Grupo Televisa SAB (NYSE:TV), which was worth $310.1 million at the end of the third quarter. On the second spot was Bill & Melinda Gates Foundation Trust which amassed $299.4 million worth of shares. Moreover, Fisher Asset Management, Foxhaven Asset Management, and Dorsal Capital Management were also bullish on Grupo Televisa SAB (NYSE:TV), allocating a large percentage of their portfolios to this stock.

Now, key hedge funds were leading the bulls’ herd. ThornTree Capital Partners, managed by Mark Moore, created the most valuable position in Grupo Televisa SAB (NYSE:TV). ThornTree Capital Partners had $14.6 million invested in the company at the end of the quarter. Guy Shahar’s DSAM Partners also initiated a $1.3 million position during the quarter. The other funds with brand new TV positions are Paul Marshall and Ian Wace’s Marshall Wace LLP and Matthew Tewksbury’s Stevens Capital Management.

Let’s now review hedge fund activity in other stocks similar to Grupo Televisa SAB (NYSE:TV). We will take a look at Juniper Networks, Inc. (NYSE:JNPR), Athene Holding Ltd. (NYSE:ATH), Fibria Celulose SA (NYSE:FBR), and Varian Medical Systems, Inc. (NYSE:VAR). This group of stocks’ market valuations match TV’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JNPR | 23 | 693266 | -4 |

| ATH | 42 | 1775251 | 6 |

| FBR | 6 | 179071 | -1 |

| VAR | 19 | 576016 | -5 |

| Average | 22.5 | 805901 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $806 million. That figure was $1.16 billion in TV’s case. Athene Holding Ltd. (NYSE:ATH) is the most popular stock in this table. On the other hand Fibria Celulose SA (NYSE:FBR) is the least popular one with only 6 bullish hedge fund positions. Grupo Televisa SAB (NYSE:TV) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ATH might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.