Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Graphic Packaging Holding Company (NYSE:GPK).

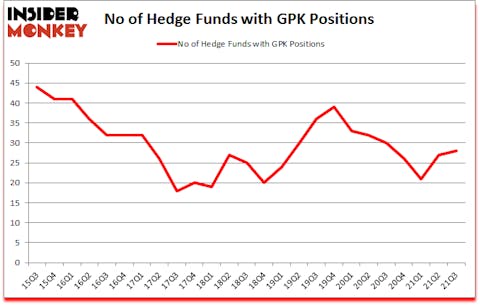

Is Graphic Packaging Holding Company (NYSE:GPK) an excellent investment today? The best stock pickers were getting more optimistic. The number of bullish hedge fund positions increased by 1 in recent months. Graphic Packaging Holding Company (NYSE:GPK) was in 28 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 44. Our calculations also showed that GPK isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings). There were 27 hedge funds in our database with GPK holdings at the end of June.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now we’re going to take a gander at the latest hedge fund action surrounding Graphic Packaging Holding Company (NYSE:GPK).

Do Hedge Funds Think GPK Is A Good Stock To Buy Now?

At the end of September, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 4% from one quarter earlier. By comparison, 30 hedge funds held shares or bullish call options in GPK a year ago. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ian Simm’s Impax Asset Management has the most valuable position in Graphic Packaging Holding Company (NYSE:GPK), worth close to $167.8 million, amounting to 0.7% of its total 13F portfolio. Sitting at the No. 2 spot is Ricky Sandler of Eminence Capital, with a $144.2 million position; 1.9% of its 13F portfolio is allocated to the stock. Remaining peers with similar optimism encompass Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors, Michael Cowley’s Sandbar Asset Management and Michael O’Keefe’s 12th Street Asset Management. In terms of the portfolio weights assigned to each position 12th Street Asset Management allocated the biggest weight to Graphic Packaging Holding Company (NYSE:GPK), around 7.61% of its 13F portfolio. Sandbar Asset Management is also relatively very bullish on the stock, setting aside 4.55 percent of its 13F equity portfolio to GPK.

As one would reasonably expect, some big names were breaking ground themselves. Cobalt Capital Management, managed by Wayne Cooperman, initiated the most valuable position in Graphic Packaging Holding Company (NYSE:GPK). Cobalt Capital Management had $7.7 million invested in the company at the end of the quarter. Peter Algert’s Algert Global also made a $0.7 million investment in the stock during the quarter. The other funds with new positions in the stock are John Murphy’s Levin Easterly Partners, Thomas Bailard’s Bailard Inc, and Frederick DiSanto’s Ancora Advisors.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Graphic Packaging Holding Company (NYSE:GPK) but similarly valued. We will take a look at Cazoo Group Ltd (NYSE:CZOO), Louisiana-Pacific Corporation (NYSE:LPX), ZIM Integrated Shipping Services Ltd. (NYSE:ZIM), Duck Creek Technologies, Inc. (NASDAQ:DCT), eXp World Holdings, Inc. (NASDAQ:EXPI), WESCO International, Inc. (NYSE:WCC), and Everbridge, Inc. (NASDAQ:EVBG). This group of stocks’ market caps are similar to GPK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CZOO | 32 | 312211 | 32 |

| LPX | 36 | 670576 | -3 |

| ZIM | 22 | 552565 | -3 |

| DCT | 17 | 234874 | -1 |

| EXPI | 22 | 107817 | 4 |

| WCC | 27 | 1174272 | 4 |

| EVBG | 23 | 1307891 | -3 |

| Average | 25.6 | 622887 | 4.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.6 hedge funds with bullish positions and the average amount invested in these stocks was $623 million. That figure was $610 million in GPK’s case. Louisiana-Pacific Corporation (NYSE:LPX) is the most popular stock in this table. On the other hand Duck Creek Technologies, Inc. (NASDAQ:DCT) is the least popular one with only 17 bullish hedge fund positions. Graphic Packaging Holding Company (NYSE:GPK) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for GPK is 54. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 31.1% in 2021 through December 9th and beat the market again by 5.1 percentage points. Unfortunately GPK wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on GPK were disappointed as the stock returned 6% since the end of September (through 12/9) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Graphic Packaging Holding Co (NYSE:GPK)

Follow Graphic Packaging Holding Co (NYSE:GPK)

Receive real-time insider trading and news alerts

Suggested Articles:

- Top 10 Places to Go as Soon as Coronavirus Pandemic Ends

- Cathie Wood’s Top 10 Stock Picks

- 30 Most Expensive Cities in the US to Rent a House

Disclosure: None. This article was originally published at Insider Monkey.