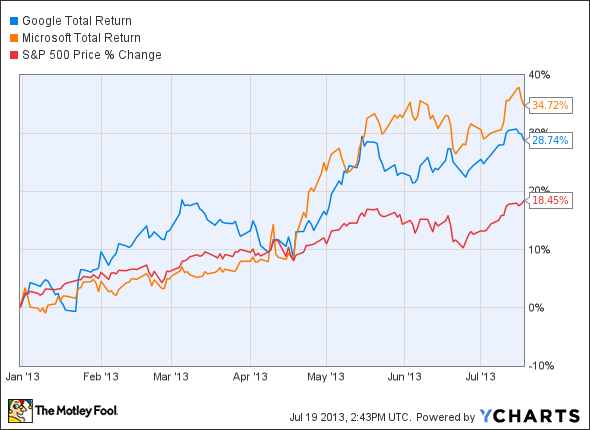

Both Google Inc (NASDAQ:GOOG) and Microsoft Corporation (NASDAQ:MSFT) headed into this Thursday’s earnings reports on a full head of steam. Investors in the two tech giants saw signs of recovery three months ago, and the stocks have been crushing the S&P 500 in 2013. In particular, Google Inc (NASDAQ:GOOG) investors looked forward to the potentially powerful impact of an improved advertising model, known as “enhanced campaigns.” For Microsoft Corporation (NASDAQ:MSFT), the positive story focused on the recent restructuring effort and a strong push into mobile computing.

GOOG Total Return Price data by YCharts

Well, the reports have been filed, and the stocks took a collective haircut. Google Inc (NASDAQ:GOOG) shares dropped as much as 4.6% on the news, while Redmond lost a massive 10% of its value overnight.

Early adopters are reporting good results from their new-and-improved ad campaigns, which combined the separate tools for browser-based and mobile ad placements into one. The new model also promises to increase targeting and control, giving advertisers a more efficient way to reach the right potential customers. But Google Inc (NASDAQ:GOOG) didn’t expect this change to boost its own results overnight. Instead, chief business officer Nikesh Arora characterized it as “a big long-term bet.”

For Microsoft Corporation (NASDAQ:MSFT), the mobile boost never happened. Investors might have guessed as much earlier on Thursday, when Mr. Softie’s most important smartphone partner Nokia Corporation (ADR) (NYSE:NOK) whiffed on its own second-quarter targets. Nokia Corporation (ADR) (NYSE:NOK) shares fell as much as 5% on that report, unleashing at least three negative analyst comments, plus one outright downgrade.

On top of that weak partnership, Microsoft Corporation (NASDAQ:MSFT) spent a ton of cash on manufacturing and marketing the Microsoft Surface tablet, which hasn’t gained much market traction from all this effort. The company posted a $900 million writedown of unsold Surface RT tablets. At the same time, Redmond’s cost of goods sold increased 14% year over year, thanks to the Surface push, but total revenue only grew by 3%.

The way I see it, Google Inc (NASDAQ:GOOG) is making appropriate long-term bets that should pay off somewhere down the road. I’m very comfortable owning my Google shares, and expect them to recover from this temporary setback very quickly.

The story is much darker in Redmond. I wouldn’t mind Microsoft Corporation (NASDAQ:MSFT) betting the house on mobility, if there were any evidence that the effort is paying off. But billion-dollar write-offs point to a failed strategy shift.

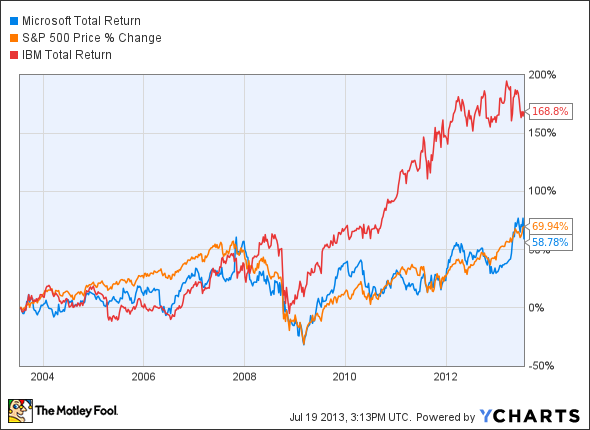

Maybe Microsoft Corporation (NASDAQ:MSFT) would be better off doubling down on the enterprise-class software portfolio instead, leaving others to battle over consumer gadgets like tablets and smartphones. Spin-off or sell the successful Xbox operation to give it the best possible shot at rewarding investors, and let the core of Microsoft go head-to-head with International Business Machines Corp.(NYSE:IBM) in the business-class sector instead.

That stragety wouldn’t be as sexy as Microsoft’s current emphasis on chasing consumer dollars, but there’s nothing wrong with boring, predictable success. I mean, take one look at this long-term comparison between boring old International Business Machines Corp.(NYSE:IBM) and unfocused Microsoft, and then tell me which stock you’d rather have owned. (Adding Google to the same chart is almost unfair, since that stock price has grown 760% over the last decade. But Microsoft clearly can’t beat Big G at its own game, while it might stand a chance in IBM’s court.)

MSFT Total Return Price data by YCharts

It’s incredible to think just how much of our digital and technological lives are almost entirely shaped and molded by just a handful of companies, with Microsoft and Google among them.

The article Google and Microsoft Earnings Disappoint; Stock Prices Fall Back originally appeared on Fool.com and is written by Anders Bylund.

Fool contributor Anders Bylund owns shares of Google. The Motley Fool recommends Google. The Motley Fool owns shares of Google, International Business (NYSE:IBM) Machines, and Microsoft.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.