We came across a bullish thesis on GE Aerospace (GE) on Asymmetric Ventures’ Substack. In this article, we will summarize the bulls’ thesis on GE. GE Aerospace (GE)’s share was trading at $241.78 as of 27th May. GE’s trailing and forward P/E were 38.14 and 43.29 respectively according to Yahoo Finance.

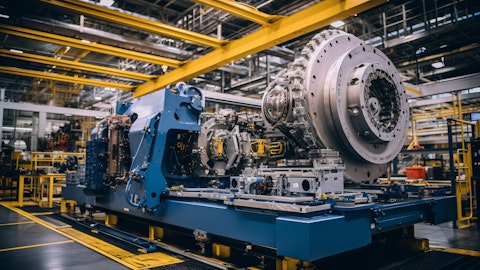

A huge in-process machining center producing parts for aircraft and aerospace systems.

GE Aerospace is a leading force in the aerospace industry, primarily generating revenue through its maintenance, repair, and overhaul (MRO) services. This segment benefits from a large installed base of engines and Power-by-the-Hour contracts, which provide customers with predictable costs and GE with stable, recurring income. The company’s extensive global network of service centers and highly trained workforce enable rapid and efficient engine servicing, reinforcing its market dominance.

Programs such as TrueChoice™ and TrueEngine™ enhance customer loyalty by allowing flexible maintenance options and improving engine performance and residual value. Additionally, GE Aerospace leverages advanced predictive maintenance technology that utilizes real-time data to anticipate engine issues, reducing downtime and lowering maintenance costs for clients. The firm maintains significant competitive advantages due to high barriers to entry, including complex engineering expertise, regulatory certifications, and long-term relationships with major aircraft manufacturers like Boeing and Airbus.

These partnerships give GE Aerospace exclusive access to key engine programs, securing a near-monopoly in several market segments. The company also benefits from a strong aftermarket position, with customers relying on GE for life-cycle support of their engines. Under CEO Larry Culp’s leadership, GE Aerospace has focused on operational efficiency, innovation, and strategic portfolio management, helping the division navigate challenges like supply chain disruptions and rising competition. Its robust balance sheet and steady cash flows position it well for ongoing investment in technology and growth initiatives.

Overall, GE Aerospace stands as a financially solid, technologically advanced leader with durable competitive moats, well poised for sustainable long-term growth in the commercial aviation market.

For a deeper look into another aerospace stock, be sure to check out our article on The Boeing Company (BA) wherein we summarized a bullish thesis by DeepValue on Substack. Since our coverage, the stock is up 11.12%.

GE Aerospace (GE) is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 104 hedge fund portfolios held GE at the end of the first quarter which was 101 in the previous quarter. While we acknowledge the risk and potential of GE as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than GE but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article was originally published at Insider Monkey.