Find Out Why Experienced Traders Choose Optimus Futures

What separates an “exceptional” broker from an “average” one? Ultimately, it depends on how well the brokerage can serve traders with different levels of experience and with different approaches to trading. Each individual trader will have specific needs based on their knowledge, experience, approach, and resources. In the end, they don’t care how well you serve other clients. What matters to them is how well you can customize your services to match their needs.

There are certain characteristics and provisions that seasoned traders expect from a top-of-the-line brokerage. Given Optimus Futures’ reputation as a knowledgeable, well-rounded, and tech-savvy firm, let’s see how Optimus might size-up to these expectations.

Please consider that futures trading is not for everyone because it entails substantial risk of loss. Past performance is not indicative of future results.

How to select the right futures broker | Here are five factors experienced traders consider when trading futures:

1. Speed Of Execution

2. Access To A Variety Of Markets

3. Platforms That Are Easy & Stable With Web And Mobile Access

4. Variety Of Clearing Firms

5. Cost Of Execution

Speed of Execution

Whether you’re scalping the markets, swing trading, or aiming for a long-term position trade, speed still matters. And when it comes to futures trading, speed is measured in Milliseconds. You want your orders to get to the exchange in the fastest way possible, whether you’re trying to score a few tick’s worth of profit or loading up a sizable position at the best available price level.

Not all traders understand the components that go into a platform’s speed. It generally boils down to two factors:

1. The speed of data coming into your charts; and

2. The speed at which your orders are routed to the exchange.

Optimus Futures gives their customer free access to their proprietary software Optimus Flow. Get a Free Two-Week Trial with Real-Time Data here. They use a technology called Rithmic that delivers all the data from the exchanges, so you see all the prices on the charts without “holes”, price averages, or gaps. This ensures that the speed of data coming in is always in real-time and delivered in the lowest latency possible.

The same can be said of order-routing speed. Measured in milliseconds, the platform discloses the speed of the connection to the exchange, which gives any trader an additional level of transparency, something that most futures platforms cannot provide.

Access to a Variety of Markets

Commodities are traded across the globe. So, if you have decided to trade futures, you’re necessarily entering the world of global trade. In that case, why limit yourself to domestic assets when you might find an advantage trading commodities specific to an international market?

For example, if US equity indices or bond futures aren’t showing a clear direction in trend, you might find opportunities in European, Asian, or other emerging market assets. You may even find opportunities to hedge against your own domestic holdings using international futures that might have a stronger fundamental basis.

If you’re a day trader, time zone can mean everything, considering that you may want to trade at the busiest parts of the trading day. If you have time to trade during the early to evening hours, your window of opportunity might coincide with the Asia-Pacific, UK, or (if you like to stay up late) European trading hours. Optimus Futures provides access to all active Futures markets worldwide through the variety of clearing firms. You can trade the Micro Emini S&P on the CME, the Oil Futures on NYMEX, Gold Futures on COMEX, The Dax on Eurex, Mini Nikkei on Osaka, or the Mini DAX on the Eurex.

If you find it advantageous to switch between international markets during a trading session, it helps to trade with a broker that allows you to make that transition as seamlessly as possible, despite the geographical location of the exchange.

Trading Platforms | Optimus Flow

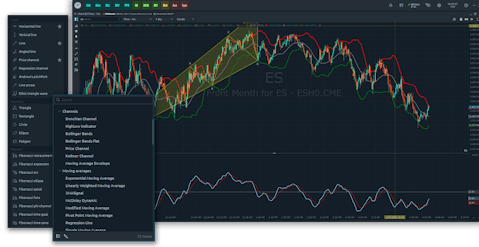

Optimus Futures signature software is a platform called “Optimus Flow.” Like other platforms, Optimus Flow allows you to trade from the charts, the DOM, or a simple order entry method. But unlike many platforms, Optimus Flow is not a “memory hog,” giving it more performance stability than other platforms that can strain performance due to memory requirements.

Another plus for the platform is its various customization options, allowing you to build, customize, and arrange windows on your screen as you see fit. This capability is important as it allows the platform to adapt to traders’ preferences rather than force traders to retrain their habits around a platform’s architecture.

Optimus Flow’s Rithmic feed allows for high-speed trading execution, comparable to those used by hedge funds, proprietary trading firms, and money managers. This is particularly advantageous during times of high volatility, particularly when you need to enter or flatten positions in a matter of microseconds.

Finally, the Technical Analysis tools are easy to find and well-designed, making your chart trading experience easier and more efficient.

Optimus Flow’s credentials are universal and can be used on all trading platforms that have access to Rithmic, including web and mobile platforms. This is an extremely valuable perk considering that Optimus Futures has a massive selection of 3rd party platforms and works with some of the leading players in the Futures industry. You can also access platforms by CQG, Trading View, MT5 and other platforms that the Optimus Futures can help you get up and running.

If you are a programmer who wishes to build algorithmic trading strategies, Optimus Futures can plug your system directly to the exchanges. Optimus Futures’ platforms (including Optimus Flow) are compatible with several coding languages, giving you the capacity to trade on your platform of choice.

The Optimus Futures staff is both fundamentally and technical-proficient. Moreover, they are always willing to help. You may come from the world of stocks, or you may be using futures to hedge your long term securities positions. The COVID-19 epidemic has brought a lot of longer-term investors seeking alternative investments or hedging tools into the futures market. So, if you happen to be one of them, wondering how to go long or short a market, how to hedge a particular position, how to find your way around matters of leverage, Optimus Futures can help.

If you’re new to the futures market, Optimus has prepared a handy guide that can help you understand how to get started. Check it out here.

Also, if you are a small trader, please consider the Emini Micros that have a smaller nominal size when trading. One of the more popular contracts has been the Micro Emini S&P and Micro NASDAQ. They can potentially be a great beginner’s contract and testing ground for those that want to practice futures day trading.

Variety of Clearing Firms

Putting The Pieces of the Puzzle Together: IB, FCM, Trading Platform and Data Providers

If you are coming from one of the larger brokers, you are probably used to having one account, broker, and software. This “all-in-one” approach can be easy to manage, but it might not necessarily be to your best advantage. If you can optimize or customize each aspect of your trading, it might help you in the long run as you’ll be in full control of your trading tools.

When you “up your game”, you might realize that a certain arrangement is not working for you, whether it’s lagging technology, higher commissions, or just overall platform layout and display. We broke down the components for you so you understand how it may work with Independent Introducing Brokers like Optimus Futures:

1. The Platform – This is the “program” or visual display of the screen you are going to trade on.

2. Data feed – Is the data feed that is used in the platform to place orders, get quotes, charting and risk management.

3. FCMs (Futures Clearing Merchant) – The only legal institutions that can hold your funds.

4. Introducing Brokers – Licensed brokers that provide the support for platforms, administrative help, and the communication between you and the FCM. They do not hold funds.

Optimus Futures is an independent Introducing brokerage. They can objectively help you decide where to hold your funds, what platform to use, and which data feed might be appropriate to your trading style. These can help you decide the best arrangement for your futures trading.

Optimus Futures knows exactly the terms and conditions of each clearing firm and will advise you as to what might be the best solution for your goals. They can also advise on the technology you should use, given their access to both their signature platforms and direct integrations to major platforms in the industry. Like other brokers, their compensation comes in the form of commissions that the FCMs pay them for the referral of the business. The good thing is that Optimus works with multiple FCMs, so their choice of FCMs are not slanted toward any one clearing firm.

Let’s use a real-life example of how Optimus Futures would use their discretion to help a potential customer:

Customer A

A Day Trader who wants to trade the Emini S&P, closes his positions daily and needs aggressive day trading margins.

Optimus Recommends: This customer needs a solution with a clearing firm (FCM) that provides low margins, low latency execution and aggressive commissions to match his style of trading.

Customers B

A Long-term trader, trades infrequently and holds positions overnight. Wants execution only platform and uses his own charting subscription.

Optimus Recommends: While Customer A needs an FCM that provides low margins and high end solution for trading, since every tick and point make a difference for the P&L (profit and loss) in day trading, customer B just needs a simple interface with execution where a tick will most likely not make a difference for his overall strategy.

The simple examples above illustrate the different types of customer needs that Optimus Futures encounters. Clearly, the customers are very different, and the advantage of working with Optimus Futures is that they’re able to differentiate the customers and match their needs to appropriate solutions.

Offline Support and Trade Desk Execution

You want access to customer support and a trade desk that operates 24 hours around the clock. If your internet drops, your Wi-Fi disconnects, or your computer malfunctions, you want the ability to call a Futures Broker support desk. The trading desk can close your positions, check on the status of your open orders, or anything else that may be related to your trading.

If you decide to establish an account with Optimus Futures, you should check with their trade desk as to trade desk procedures should you ever need to use this service.

Cost of Execution and Commissions

Optimus Futures provides a sliding commission schedule should traders need to increase their trading volume. The cost of commissions is transparent and will always be discussed upfront before you even open an account. The guidelines are posted here for your discretion.

Please keep in mind that the cost of execution does not only rely on brokers, but rather the technology that you are using. Data providers and platform suppliers dictate their own prices, but luckily you have a variety to choose from. Let Optimus Futures guide you through the options for your trading. Commissions do make a difference but bad execution and mismatch with technology can be very costly considering that “slippage” (price gaps in fills) adds up very fast.

In Conclusion

There are no “best” brokers. There are only “better” brokers for your specific situation as a Futures trader. Optimus Futures provides the tools (in our opinion) that most traders require, starting with platforms designed for both beginner and technical traders, an organized back office for account and technical support, trade desks to assist with trading functionalities, while also providing institutional type services to money managers and hedgers.

Contact Optimus Futures at:

Toll Free – (800) 771-6748

International – (561) 367-8686

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. We urge you to conduct your own due diligence.

Subsribe to Insider Monkey’s free daily enewsletter to receive email alerts whenever we publish a notable article:

Disclosure: This article is originally published at Insider Monkey. Insider Monkey received compensation in exchange for publishing this article. Insider Monkey doesn’t recommend purchase/sale of any securities. Please get in touch with a financial professional before making any financial decisions. You understand that Insider Monkey doesn’t accept any responsibility and you will be using the information presented here at your own risk. You acknowledge that this disclaimer is a simplified version of our Terms of Use, and by accessing or using our site, you agree to be bound by all of its terms and conditions. If at any time you find these terms and conditions unacceptable, you must immediately leave the Site and cease all use of the Site.