Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index ETF (SPY) lost 8.7% through October 26th. Forty percent of the S&P 500 constituents were down more than 10%. The average return of a randomly picked stock in the index is -9.5%. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 25 most popular S&P 500 stocks among hedge funds had an average loss of 8.8%. In this article, we will take a look at what hedge funds think about Fresenius Medical Care AG & Co. (NYSE:FMS).

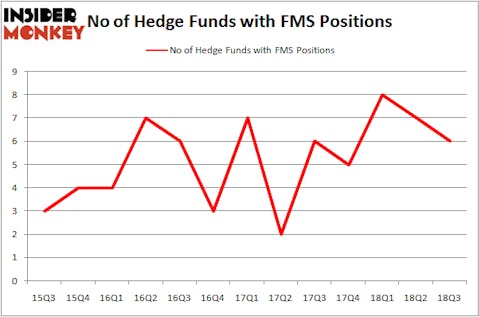

Is Fresenius Medical Care AG & Co. (NYSE:FMS) the right pick for your portfolio? The best stock pickers are taking a bearish view. The number of bullish hedge fund positions fell by 1 recently. Our calculations also showed that FMS isn’t among the 30 most popular stocks among hedge funds. FMS was in 6 hedge funds’ portfolios at the end of September. There were 7 hedge funds in our database with FMS positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the fresh hedge fund action regarding Fresenius Medical Care AG & Co. (NYSE:FMS).

What have hedge funds been doing with Fresenius Medical Care AG & Co. (NYSE:FMS)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from one quarter earlier. By comparison, 5 hedge funds held shares or bullish call options in FMS heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Arrowstreet Capital held the most valuable stake in Fresenius Medical Care AG & Co. (NYSE:FMS), which was worth $21.4 million at the end of the third quarter. On the second spot was Sivik Global Healthcare which amassed $2.1 million worth of shares. Moreover, D E Shaw, Renaissance Technologies, and Citadel Investment Group were also bullish on Fresenius Medical Care AG & Co. (NYSE:FMS), allocating a large percentage of their portfolios to this stock.

Because Fresenius Medical Care AG & Co. (NYSE:FMS) has experienced a decline in interest from the aggregate hedge fund industry, logic holds that there was a specific group of money managers that elected to cut their full holdings by the end of the third quarter. Intriguingly, Israel Englander’s Millennium Management dropped the biggest position of all the hedgies followed by Insider Monkey, valued at close to $1.5 million in stock. Alec Litowitz and Ross Laser’s fund, Magnetar Capital, also dropped its stock, about $0.9 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 1 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks similar to Fresenius Medical Care AG & Co. (NYSE:FMS). These stocks are Align Technology, Inc. (NASDAQ:ALGN), ArcelorMittal (NYSE:MT), Nokia Corporation (NYSE:NOK), and Sempra Energy (NYSE:SRE). This group of stocks’ market values resemble FMS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ALGN | 37 | 2166489 | 1 |

| MT | 14 | 179765 | -2 |

| NOK | 19 | 520867 | 5 |

| SRE | 33 | 2912686 | 11 |

| Average | 25.75 | 1444952 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $1.45 billion. That figure was $27 million in FMS’s case. Align Technology, Inc. (NASDAQ:ALGN) is the most popular stock in this table. On the other hand ArcelorMittal (NYSE:MT) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Fresenius Medical Care AG & Co. (NYSE:FMS) is even less popular than MT. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.