It was a great first half for many investors as the market, as measured by the S&P 500, was up by about 10%. The health care sector led the way as it appreciated 19.1%. Even investors in slower growing sectors like utilities and energy did well, as those two sectors were up 7.7% and 8.6%, respectively. That being said, not all investors felt the market’s lift evenly, though all sectors were positive. The one sector that wasn’t very kind to investors was the materials sector, which squeaked by with the lowest appreciation at 1.7%, though many stocks in the sector simply got crushed. Let’s take a look at what went wrong.

Hint, following the yellow brick road didn’t lead anywhere good. Source: Gold Footpath by George Hodan.

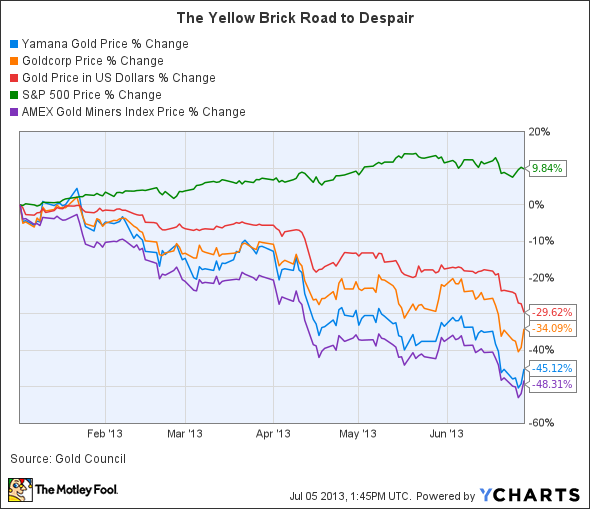

Gold stocks have been hit particularly hard so far this year. Investors in gold miners like Goldcorp Inc. (NYSE:GG) and Yamana Gold Inc. (NYSE:AUY) have been crushed as those stocks are down by 34% and 45%, respectively. The big culprit here is that gold has completely lost its luster with investors. The shiny metal fell to a three-year low of under $1,200 an ounce. In the second quarter alone the price of gold dropped by more than $400 an ounce, which was a 25% plunge. The following chart shows just how bad it’s been for gold miners.

Gold investors weren’t the only ones having a rough year. Other commodities like silver and copper have been sinking this year as well. That has sent top stocks like Silver Wheaton Corp. (NYSE:SLW) and Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX) down by double digits. Again, looking at the chart, you can see a pretty big correlation between falling commodity prices and the subsequent fall in the price of each stock.

New York Silver Price data by YCharts

New York Silver Price data by YCharts

Many of these companies were hit by a one-two punch as falling commodity prices were magnified by company specific issues. Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX), for example, spend most of the year working to close its transformative oil and gas deals. The company was also hurt by a collapse at one of its top mines, which forced it to shut down production. Meanwhile, Goldcorp Inc. (NYSE:GG) endured project start-up delays at its Cerro Negro mine in Argentina. Even silver streamer Silver Wheaton Corp. (NYSE:SLW) was hurt by a project start-up delay as the company, which has a silver streaming agreement for the Pascua-Lama mine in Chile, was hit by that mine’s water issue delay. The mining industry has been riddled by both cost overruns and start-up delays, which have really hit profits and taken the stocks down with it.