The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Franks International NV (NYSE:FI).

Franks International NV (NYSE:FI) shareholders have witnessed an increase in hedge fund interest of late. FI was in 11 hedge funds’ portfolios at the end of September. There were 5 hedge funds in our database with FI holdings at the end of the previous quarter. Our calculations also showed that FI isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most market participants, hedge funds are seen as underperforming, outdated investment tools of years past. While there are greater than 8,000 funds trading at the moment, Our researchers choose to focus on the moguls of this group, about 700 funds. These investment experts watch over most of the smart money’s total capital, and by keeping track of their finest stock picks, Insider Monkey has discovered a few investment strategies that have historically outrun the market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a look at the fresh hedge fund action encompassing Franks International NV (NYSE:FI).

How are hedge funds trading Franks International NV (NYSE:FI)?

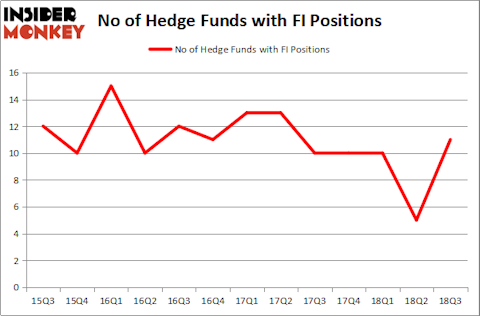

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 120% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in FI over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Franks International NV (NYSE:FI) was held by First Pacific Advisors LLC, which reported holding $16 million worth of stock at the end of September. It was followed by Adage Capital Management with a $9.4 million position. Other investors bullish on the company included Laurion Capital Management, Citadel Investment Group, and Gotham Asset Management.

Now, key hedge funds were leading the bulls’ herd. Laurion Capital Management, managed by Benjamin A. Smith, assembled the biggest position in Franks International NV (NYSE:FI). Laurion Capital Management had $6.6 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $2 million position during the quarter. The following funds were also among the new FI investors: D. E. Shaw’s D E Shaw, Steve Cohen’s Point72 Asset Management, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Franks International NV (NYSE:FI) but similarly valued. These stocks are Pattern Energy Group Inc (NASDAQ:PEGI), Chesapeake Lodging Trust (NYSE:CHSP), Columbia Financial, Inc. (NASDAQ:CLBK), and EVO Payments, Inc. (NASDAQ:EVOP). This group of stocks’ market values resemble FI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PEGI | 9 | 23059 | 1 |

| CHSP | 9 | 9673 | 1 |

| CLBK | 7 | 25066 | 1 |

| EVOP | 14 | 57954 | 2 |

| Average | 9.75 | 28938 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $29 million. That figure was $39 million in FI’s case. EVO Payments, Inc. (NASDAQ:EVOP) is the most popular stock in this table. On the other hand Columbia Financial, Inc. (NASDAQ:CLBK) is the least popular one with only 7 bullish hedge fund positions. Franks International NV (NYSE:FI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard EVOP might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.