After opening rather calmly on the news that Donald Trump is now the President-elect, the markets are down slightly as investors remain cautious on the political changes ahead.

Amid the calm backdrop, shares of five stocks, Ariad Pharmaceuticals, Inc. (NASDAQ:ARIA), Mylan NV (NASDAQ:MYL), Tesla Motors Inc (NASDAQ:TSLA), SolarCity Corp (NASDAQ:SCTY), and E*TRADE Financial Corp (NASDAQ:ETFC), are each on the move. Let’s take a look at why traders are buying and selling these stocks and analyze the smart money sentiment toward them.

We believe that imitating hedge funds and other large institutional investors can be helpful in identifying stocks capable of outperforming the broader market. Through extensive research that covered portfolios of several hundred large investors between 1999 and 2012, we determined that following the small-cap stocks that large money managers are collectively bullish on, can generate monthly returns nearly 1.0 percentage points above the market (see the details here).

Hadrian / Shutterstock.com

Ariad Pharmaceuticals, Inc. (NASDAQ:ARIA) shares have popped by 17% on the back of the news that Donald Trump has won the Presidency. Shares of Ariad previously fell sharply after Democratic senator Bernie Sanders criticized Ariad for raising the price of its leukemia drug, iclusig, to almost $200,000 a year. Although Trump has said that no one will die on the streets if he is President, traders evidently think that the President-elect will be more favorable to drug companies than Clinton would have been. That likely means more freedom for Ariad in terms of pricing for iclusig. Among the funds we track, 27 funds owned $326.28 million worth of Ariad Pharmaceuticals, Inc. (NASDAQ:ARIA)’s stock, which accounted for 23.10% of the float on June 30, versus 26 funds and $296.02 million, respectively, on March 31.

Follow Ariad Pharmaceuticals Inc (NASDAQ:ARIA)

Follow Ariad Pharmaceuticals Inc (NASDAQ:ARIA)

Receive real-time insider trading and news alerts

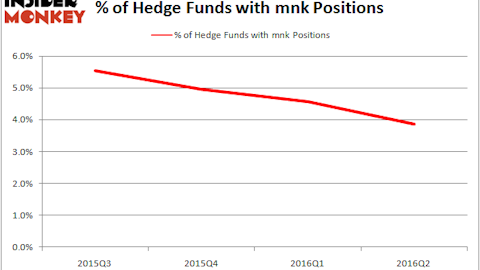

Like Ariad, shares of Mylan NV (NASDAQ:MYL) are well in the green today on the back of the news that Trump will be the 45th President of the United States. Given that Trump has promised to roll-back regulations on business, the prospect of Department of Justice charges with teeth on various generic drug makers for alleged collusion is suddenly a lot lower. If the Department of Justice doesn’t charge the various generic drug makers, there will be a lot less uncertainty in the sector, which could lead to higher valuations. 44 top funds owned shares of Mylan NV (NASDAQ:MYL) at the end of June, down 7 funds from the previous quarter.

Follow Mylan Inc. (Old Filings) (NASDAQ:MYL)

Follow Mylan Inc. (Old Filings) (NASDAQ:MYL)

Receive real-time insider trading and news alerts

On the next page, we find out why Tesla Motors Inc, SolarCity Corp, and E*TRADE Financial Corp are on the move.

SolarCity Corp (NASDAQ:SCTY) and Tesla Motors Inc (NASDAQ:TSLA) are each down by more than 4% today as some traders become more cautious on the renewable energy/EV names in light of Trump winning the Presidency. It’s no secret that Elon Musk and Tesla have benefited enormously from U.S. government backing in terms of contract awards and EV tax credits in the past and present. Given that Trump is more in favor of the oil and gas industry and the rust belt was integral to his victory yesterday, it remains to be seen whether Tesla can continue to realize the same level of support as the market previously expected. According to our records, 36 and 26 top funds were long Tesla Motors Inc (NASDAQ:TSLA) and SolarCity Corp (NASDAQ:SCTY) at the end of June.

Follow Tesla Inc. (NASDAQ:TSLA)

Follow Tesla Inc. (NASDAQ:TSLA)

Receive real-time insider trading and news alerts

Follow Solarcity Corp (OTC:SCTY)

Follow Solarcity Corp (OTC:SCTY)

Receive real-time insider trading and news alerts

Last but not least, E*TRADE Financial Corp (NASDAQ:ETFC) shares have popped 3.5% due to improved sentiment. Although some traders think the Federal Reserve might be less inclined to raise the Federal Funds rate in December if the market sells off, the interest rates will happen eventually and E*TRADE will benefit. Given that Trump has also said that he will roll back regulation and lower taxes on businesses, some traders think E*TRADE could potentially have less expenses and higher margins. Leon Cooperman’s Omega Advisors was long 3.1 million shares of E*TRADE Financial Corp (NASDAQ:ETFC) on June 30.

Follow E Trade Financial Corp (NASDAQ:ETFC)

Follow E Trade Financial Corp (NASDAQ:ETFC)

Receive real-time insider trading and news alerts

Disclosure: none