Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 30 stock picks easily bested the broader market, at 6.7% compared to 2.6%, despite there being a few duds in there like Facebook (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

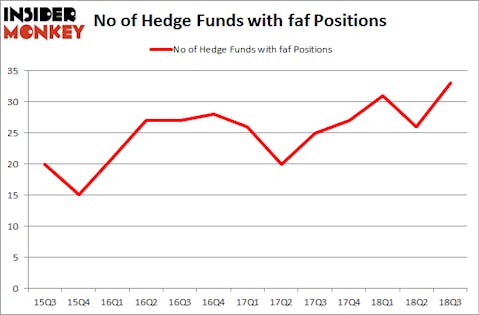

First American Financial Corp (NYSE:FAF) investors should be aware of an increase in hedge fund sentiment recently. FAF was in 33 hedge funds’ portfolios at the end of the third quarter of 2018. There were 26 hedge funds in our database with FAF holdings at the end of the previous quarter. Our calculations also showed that faf isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are many tools stock market investors have at their disposal to value publicly traded companies. Some of the less utilized tools are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the best investment managers can beat the broader indices by a significant margin (see the details here).

Let’s view the new hedge fund action surrounding First American Financial Corp (NYSE:FAF).

What have hedge funds been doing with First American Financial Corp (NYSE:FAF)?

At Q3’s end, a total of 33 of the hedge funds tracked by Insider Monkey were long this stock, a change of 27% from one quarter earlier. By comparison, 27 hedge funds held shares or bullish call options in FAF heading into this year. With the smart money’s positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, John W. Rogers’s Ariel Investments has the largest position in First American Financial Corp (NYSE:FAF), worth close to $229.4 million, amounting to 2.5% of its total 13F portfolio. The second most bullish fund manager is AQR Capital Management, led by Cliff Asness, holding a $84.5 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish encompass Ken Fisher’s Fisher Asset Management, Israel Englander’s Millennium Management and D. E. Shaw’s D E Shaw.

Consequently, some big names were breaking ground themselves. Carlson Capital, managed by Clint Carlson, created the most outsized position in First American Financial Corp (NYSE:FAF). Carlson Capital had $19.2 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $5 million position during the quarter. The other funds with new positions in the stock are Michael O’Keefe’s 12th Street Asset Management, Matthew Tewksbury’s Stevens Capital Management, and Alec Litowitz and Ross Laser’s Magnetar Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as First American Financial Corp (NYSE:FAF) but similarly valued. We will take a look at Lazard Ltd (NYSE:LAZ), Newfield Exploration Co. (NYSE:NFX), Dr. Reddy’s Laboratories Limited (NYSE:RDY), and Starwood Property Trust, Inc. (NYSE:STWD). This group of stocks’ market values resemble FAF’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LAZ | 17 | 468779 | 0 |

| NFX | 39 | 375919 | 16 |

| RDY | 9 | 72351 | -2 |

| STWD | 21 | 187809 | 2 |

| Average | 21.5 | 276215 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $276 million. That figure was $620 million in FAF’s case. Newfield Exploration Co. (NYSE:NFX) is the most popular stock in this table. On the other hand Dr. Reddy’s Laboratories Limited (NYSE:RDY) is the least popular one with only 9 bullish hedge fund positions. First American Financial Corp (NYSE:FAF) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NFX might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.