Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in FireEye Inc (NASDAQ:FEYE)? The smart money sentiment can provide an answer to this question.

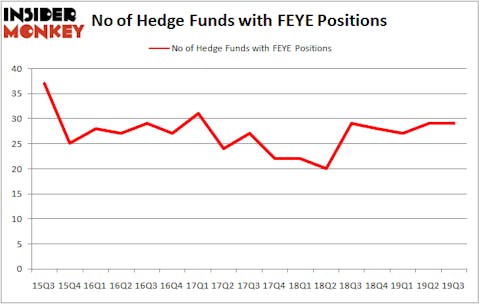

Hedge fund interest in FireEye Inc (NASDAQ:FEYE) shares was flat at the end of last quarter. Hedge funds were patiently waiting for FEYE shares to take off during the third quarter. At the end of this article we will also compare FEYE to other stocks including Coca-Cola Consolidated, Inc. (NASDAQ:COKE), QTS Realty Trust Inc (NYSE:QTS), and Moog Inc (NYSE:MOG) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most investors, hedge funds are viewed as slow, outdated investment tools of yesteryear. While there are more than 8000 funds trading at present, Our experts hone in on the top tier of this group, around 750 funds. These money managers administer the majority of the hedge fund industry’s total asset base, and by observing their first-class equity investments, Insider Monkey has come up with a number of investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to analyze the recent hedge fund action surrounding FireEye Inc (NASDAQ:FEYE).

What does smart money think about FireEye Inc (NASDAQ:FEYE)?

Heading into the fourth quarter of 2019, a total of 29 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. By comparison, 29 hedge funds held shares or bullish call options in FEYE a year ago. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

The largest stake in FireEye Inc (NASDAQ:FEYE) was held by Citadel Investment Group, which reported holding $88 million worth of stock at the end of September. It was followed by Fisher Asset Management with a $36.7 million position. Other investors bullish on the company included Masters Capital Management, Renaissance Technologies, and Osterweis Capital Management. In terms of the portfolio weights assigned to each position Kettle Hill Capital Management allocated the biggest weight to FireEye Inc (NASDAQ:FEYE), around 3.79% of its portfolio. Boardman Bay Capital Management is also relatively very bullish on the stock, dishing out 2.8 percent of its 13F equity portfolio to FEYE.

Because FireEye Inc (NASDAQ:FEYE) has witnessed a decline in interest from the smart money, we can see that there were a few fund managers that elected to cut their positions entirely heading into Q4. It’s worth mentioning that Anand Parekh’s Alyeska Investment Group sold off the largest position of the “upper crust” of funds tracked by Insider Monkey, worth close to $50.9 million in stock, and Cynthia Paul’s Lynrock Lake was right behind this move, as the fund said goodbye to about $16 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as FireEye Inc (NASDAQ:FEYE) but similarly valued. These stocks are Coca-Cola Consolidated, Inc. (NASDAQ:COKE), QTS Realty Trust Inc (NYSE:QTS), Moog Inc (NYSE:MOG), and AllianceBernstein Holding LP (NYSE:AB). This group of stocks’ market valuations match FEYE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COKE | 14 | 20018 | 3 |

| QTS | 24 | 382800 | 1 |

| MOG | 20 | 102823 | 2 |

| AB | 8 | 18589 | -2 |

| Average | 16.5 | 131058 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $131 million. That figure was $255 million in FEYE’s case. QTS Realty Trust Inc (NYSE:QTS) is the most popular stock in this table. On the other hand AllianceBernstein Holding LP (NYSE:AB) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks FireEye Inc (NASDAQ:FEYE) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on FEYE as the stock returned 25.6% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.