The government requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30. We at Insider Monkey have made an extensive database of more than 700 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Fibria Celulose SA (NYSE:FBR) based on those filings.

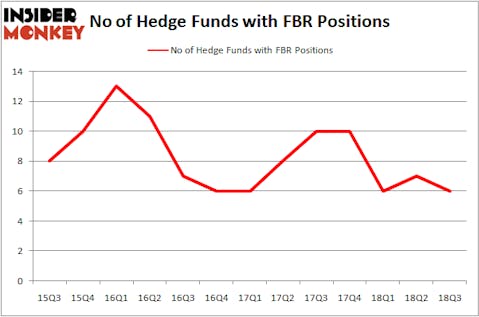

Fibria Celulose SA (NYSE:FBR) shareholders have witnessed a decrease in activity from the world’s largest hedge funds of late. Our calculations also showed that FBR isn’t among the 30 most popular stocks among hedge funds.

Today there are a multitude of tools market participants employ to value their holdings. Two of the most innovative tools are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the elite fund managers can outperform the S&P 500 by a significant amount (see the details here).

Cliff Asness of AQR Capital Management

Let’s check out the latest hedge fund action surrounding Fibria Celulose SA (NYSE:FBR).

How are hedge funds trading Fibria Celulose SA (NYSE:FBR)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from the second quarter of 2018. By comparison, 10 hedge funds held shares or bullish call options in FBR heading into this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Fibria Celulose SA (NYSE:FBR), with a stake worth $155.3 million reported as of the end of September. Trailing Renaissance Technologies was Arrowstreet Capital, which amassed a stake valued at $20.6 million. AQR Capital Management, D E Shaw, and Bailard Inc were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Fibria Celulose SA (NYSE:FBR) has faced a decline in interest from hedge fund managers, we can see that there lies a certain “tier” of fund managers that decided to sell off their entire stakes by the end of the third quarter. It’s worth mentioning that Noam Gottesman’s GLG Partners sold off the biggest position of the 700 funds followed by Insider Monkey, comprising close to $66.4 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund dumped about $1 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 1 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks similar to Fibria Celulose SA (NYSE:FBR). These stocks are Varian Medical Systems, Inc. (NYSE:VAR), Michael Kors Holdings Ltd (NYSE:KORS), Qurate Retail, Inc. (NASDAQ:QRTEA), and Open Text Corporation (NASDAQ:OTEX). This group of stocks’ market values match FBR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VAR | 19 | 576016 | -5 |

| KORS | 47 | 1555977 | 12 |

| QRTEA | 36 | 1096657 | 0 |

| OTEX | 19 | 759011 | 6 |

| Average | 30.25 | 996915 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.25 hedge funds with bullish positions and the average amount invested in these stocks was $997 million. That figure was $179 million in FBR’s case. Michael Kors Holdings Ltd (NYSE:KORS) is the most popular stock in this table. On the other hand Varian Medical Systems, Inc. (NYSE:VAR) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks Fibria Celulose SA (NYSE:FBR) is even less popular than VAR. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.