How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding F.N.B. Corp (NYSE:FNB).

Hedge fund interest in F.N.B. Corp (NYSE:FNB) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Sabra Health Care REIT Inc (NASDAQ:SBRA), Yelp Inc (NYSE:YELP), and Stamps.com Inc. (NASDAQ:STMP) to gather more data points.

If you’d ask most investors, hedge funds are perceived as unimportant, outdated investment tools of the past. While there are greater than 8,000 funds with their doors open at the moment, Our experts hone in on the crème de la crème of this club, approximately 700 funds. These hedge fund managers control the lion’s share of all hedge funds’ total capital, and by observing their best stock picks, Insider Monkey has spotted numerous investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to view the fresh hedge fund action encompassing F.N.B. Corp (NYSE:FNB).

Hedge fund activity in F.N.B. Corp (NYSE:FNB)

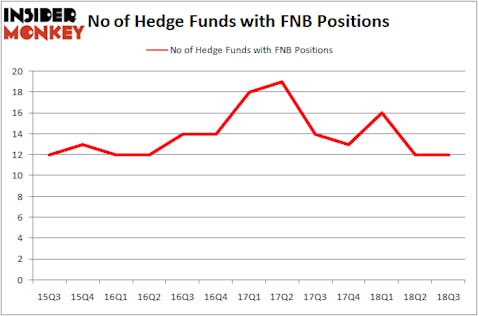

Heading into the fourth quarter of 2018, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, no change from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards FNB over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Basswood Capital was the largest shareholder of F.N.B. Corp (NYSE:FNB), with a stake worth $18.1 million reported as of the end of September. Trailing Basswood Capital was EJF Capital, which amassed a stake valued at $16.8 million. GLG Partners, Polaris Capital Management, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Since F.N.B. Corp (NYSE:FNB) has faced bearish sentiment from the entirety of the hedge funds we track, logic holds that there is a sect of hedge funds that elected to cut their positions entirely last quarter. At the top of the heap, D. E. Shaw’s D E Shaw dumped the largest position of the “upper crust” of funds followed by Insider Monkey, totaling close to $3.7 million in stock. Steve Cohen’s fund, Point72 Asset Management, also said goodbye to its stock, about $3.4 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to F.N.B. Corp (NYSE:FNB). These stocks are Sabra Health Care REIT Inc (NASDAQ:SBRA), Yelp Inc (NYSE:YELP), Stamps.com Inc. (NASDAQ:STMP), and Chesapeake Energy Corporation (NYSE:CHK). This group of stocks’ market values match FNB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SBRA | 9 | 58109 | -3 |

| YELP | 30 | 1018373 | 4 |

| STMP | 38 | 600765 | 6 |

| CHK | 22 | 213997 | 3 |

| Average | 24.75 | 472811 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.75 hedge funds with bullish positions and the average amount invested in these stocks was $473 million. That figure was $52 million in FNB’s case. Stamps.com Inc. (NASDAQ:STMP) is the most popular stock in this table. On the other hand Sabra Health Care REIT Inc (NASDAQ:SBRA) is the least popular one with only 9 bullish hedge fund positions. F.N.B. Corp (NYSE:FNB) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard STMP might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.