Baron Funds, an investment management company, released its “Baron Health Care Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. The fund declined 6.05% (Institutional Shares) in the quarter compared to a 3.88% loss for the Russell 3000 Health Care Index and a 3.27% loss for the S&P 500 Index. Year-to-date through September 30, 2023, the fund declined 1.17%, compared to a 3.83% decline for the Russell 3000 Health Care Index and a 13.07% increase for the S&P 500 Index. The combination of stock selection and active sub-industry weights drove the underperformance of the fund in the quarter. In addition, please check the fund’s top five holdings to know its best picks in 2023.

Baron Health Care Fund highlighted stocks like Exact Sciences Corporation (NASDAQ:EXAS) in the third quarter 2023 investor letter. Headquartered in Madison, Wisconsin, Exact Sciences Corporation (NASDAQ:EXAS) provides cancer screening and diagnostic test products. On October 18, 2023, Exact Sciences Corporation (NASDAQ:EXAS) stock closed at $65.48 per share. One-month return of Exact Sciences Corporation (NASDAQ:EXAS) was -4.96%, and its shares gained 106.31% of their value over the last 52 weeks. Exact Sciences Corporation (NASDAQ:EXAS) has a market capitalization of $11.938 billion.

Baron Health Care Fund made the following comment about Exact Sciences Corporation (NASDAQ:EXAS) in its Q3 2023 investor letter:

“Exact Sciences Corporation (NASDAQ:EXAS) is a cancer diagnostics company whose flagship product is Cologuard, a stool-based screening test for colon cancer. The stock declined because financial results did not satisfy lofty expectations and there was a broader sell-off in the diagnostics stocks. We retain conviction in the investment, though we reduced the position size to manage risk ahead of privately held company Freenome’s clinical trial readout of a potentially competing blood-based screening test for colorectal cancer. We believe the screening market for colon cancer is vast, and management continues to build optionality by moving several liquid biopsy programs of their own through the pipeline.”

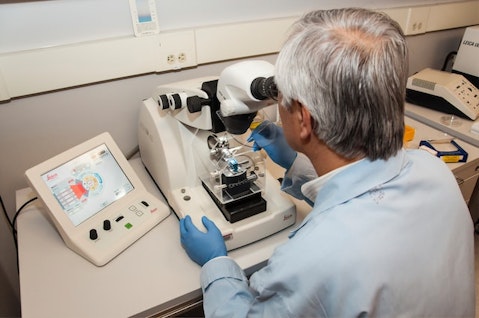

Photo by National Cancer Institute on Unsplash

Exact Sciences Corporation (NASDAQ:EXAS) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 45 hedge fund portfolios held Exact Sciences Corporation (NASDAQ:EXAS) at the end of second quarter which was 38 in the previous quarter.

We discussed Exact Sciences Corporation (NASDAQ:EXAS) in another article and shared Artisan Mid Cap Fund’s views on the company. In addition, please check out our hedge fund investor letters Q3 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 30 Celebrities Who Have Normal Jobs Now

- 12 Best Value Dividend Stocks to Buy According to Warren Buffett

- The 30 Most Underpaid Jobs in America

Disclosure: None. This article is originally published at Insider Monkey.