Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow nearly 900 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Evans Bancorp Inc. (NYSE:EVBN), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

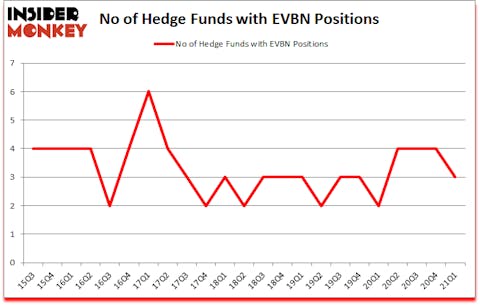

Is Evans Bancorp Inc. (NYSE:EVBN) a sound investment now? Hedge funds were getting less optimistic. The number of long hedge fund positions decreased by 1 recently. Evans Bancorp Inc. (NYSE:EVBN) was in 3 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 6. Our calculations also showed that EVBN isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In the financial world there are dozens of gauges shareholders can use to size up publicly traded companies. A pair of the most under-the-radar gauges are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the best picks of the top investment managers can outpace the market by a solid amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, an activist hedge fund wants to buy this $26 biotech stock for $50. So, we recommended a long position to our monthly premium newsletter subscribers. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to take a look at the fresh hedge fund action surrounding Evans Bancorp Inc. (NYSE:EVBN).

Do Hedge Funds Think EVBN Is A Good Stock To Buy Now?

At the end of the first quarter, a total of 3 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -25% from the fourth quarter of 2020. On the other hand, there were a total of 2 hedge funds with a bullish position in EVBN a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Evans Bancorp Inc. (NYSE:EVBN), which was worth $1 million at the end of the fourth quarter. On the second spot was Basswood Capital which amassed $0.1 million worth of shares. Ancora Advisors was also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Basswood Capital allocated the biggest weight to Evans Bancorp Inc. (NYSE:EVBN), around 0.0026% of its 13F portfolio. Renaissance Technologies is also relatively very bullish on the stock, earmarking 0.0013 percent of its 13F equity portfolio to EVBN.

Due to the fact that Evans Bancorp Inc. (NYSE:EVBN) has witnessed falling interest from the aggregate hedge fund industry, it’s easy to see that there exists a select few hedge funds that slashed their full holdings last quarter. It’s worth mentioning that Lawrence Seidman’s Seidman Investment Partnership sold off the largest stake of the 750 funds followed by Insider Monkey, totaling close to $0.5 million in stock, and Michael Price’s MFP Investors was right behind this move, as the fund said goodbye to about $0.4 million worth. These transactions are interesting, as aggregate hedge fund interest fell by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to Evans Bancorp Inc. (NYSE:EVBN). These stocks are Select Interior Concepts, Inc. (NASDAQ:SIC), Gold Royalty Corp. (NYSE:GROY), Gold Standard Ventures Corp (NYSE:GSV), RigNet Inc (NASDAQ:RNET), Velocity Financial, Inc. (NYSE:VEL), scPharmaceuticals Inc. (NASDAQ:SCPH), and RGC Resources, Inc. (NASDAQ:RGCO). This group of stocks’ market valuations match EVBN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIC | 12 | 18500 | -4 |

| GROY | 2 | 3186 | 2 |

| GSV | 4 | 23065 | -4 |

| RNET | 11 | 34970 | 4 |

| VEL | 5 | 34132 | -2 |

| SCPH | 8 | 68427 | -1 |

| RGCO | 1 | 2382 | 0 |

| Average | 6.1 | 26380 | -0.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.1 hedge funds with bullish positions and the average amount invested in these stocks was $26 million. That figure was $1 million in EVBN’s case. Select Interior Concepts, Inc. (NASDAQ:SIC) is the most popular stock in this table. On the other hand RGC Resources, Inc. (NASDAQ:RGCO) is the least popular one with only 1 bullish hedge fund positions. Evans Bancorp Inc. (NYSE:EVBN) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for EVBN is 28.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.2% in 2021 through June 11th and still beat the market by 3.3 percentage points. A small number of hedge funds were also right about betting on EVBN as the stock returned 14.3% since the end of the first quarter (through 6/11) and outperformed the market by an even larger margin.

Follow Evans Bancorp Inc (AMEX:EVBN)

Follow Evans Bancorp Inc (AMEX:EVBN)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.