J.M. Smucker Co.’s analysis versus peers uses the following peer-set: General Mills, Inc. (NYSE:GIS), H.J. Heinz Company (NYSE:HNZ), ConAgra Foods, Inc. (NYSE:CAG), Ralcorp Holdings, Inc. (NYSE:RAH), Green Mountain Coffee Roasters Inc. (NASDAQ:GMCR), The Hain Celestial Group, Inc. (NASDAQ:HAIN), TreeHouse Foods Inc. (NYSE:THS) and B&G Foods, Inc. (NYSE:BGS). The table below shows the preliminary results along with the recent trend for revenues, net income and returns.

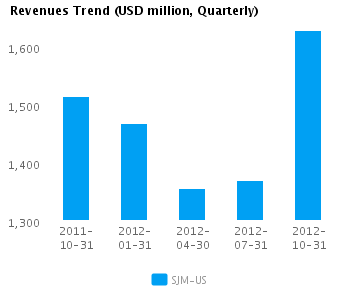

| Quarterly (USD million) | 2012-10-31 | 2012-07-31 | 2012-04-30 | 2012-01-31 | 2011-10-31 |

|---|---|---|---|---|---|

| Revenues | 1,628.7 | 1,369.7 | 1,355.4 | 1,467.6 | 1,513.9 |

| Revenue Growth % | 18.9 | 1.1 | (7.7) | (3.1) | 27.3 |

| Net Income | 148.8 | 109.9 | 103.3 | 115.9 | 126.0 |

| Net Income Growth % | 35.4 | 6.4 | (10.9) | (8.0) | 14.1 |

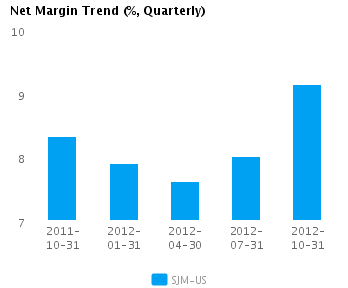

| Net Margin % | 9.1 | 8.0 | 7.6 | 7.9 | 8.3 |

| ROE % (Annualized) | 11.5 | 8.5 | 7.8 | 8.6 | 9.4 |

| ROA % (Annualized) | 6.5 | 4.8 | 4.5 | 5.0 | 5.6 |

Valuation Drivers

J.M. Smucker Co.’s current Price/Book of 1.8 is about median in its peer group. The market expects SJM-US to grow earnings about as fast as the median of its chosen peers (PE of 19.5 compared to peer median of 19.6) but not to expect much improvement in its below peer median rates of return (ROE of 9.1% compared to the peer median ROE of 13.6%).

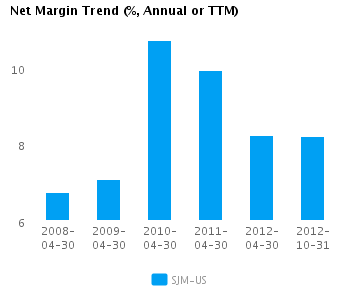

The company employs relatively high amounts of assets (with a turnover of 0.6x compared to peer median of 0.8x) while generating profit margins of 8.2% that are only about median among its chosen peers. SJM-US’s net margin continues to trend downward and is now similar to its five-year average net margin of 8.5%.

Economic Moat

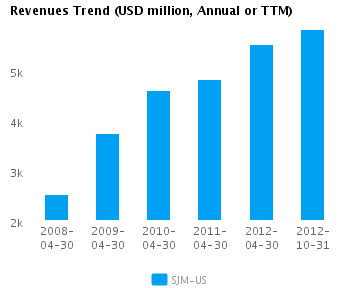

Growth in SJM-US’s revenues and earnings have been in-line with its chosen peers (annual revenue growth of 14.5% and earnings growth of -5.0% respectively). Its top-line performance seems to imply ‘more of the same’ for earnings. SJM-US is currently converting every 1% of change in revenue into -0.3% change in annual reported earnings.

SJM-US’s return on assets currently is around peer median (5.2% vs. peer median 6.1%) — similar to its returns over the past five years (5.6% vs. peer median 5.4%). This performance suggests that the company has no specific competitive advantages relative to its peers.

The company’s gross margin of 35.7% is around peer median suggesting that SJM-US’s operations do not benefit from any differentiating pricing advantage. In addition, SJM-US’s pre-tax margin of 12.6% is also around the peer median suggesting no operating cost advantage relative to peers.

Growth & Investment Strategy

While SJM-US’s revenues have grown faster than the peer median (13.7% vs. 6.7% respectively for the past three years), the market gives the stock an about peer median PE ratio of 19.5. This suggests that the market has some questions about the company’s long-term strategy.

SJM-US’s annualized rate of change in capital of 3.8% over the past three years is less than its peer median of 7.0%. This investment has generated a peer median return on capital of 7.3% averaged over the same three years. The median return on capital investment on a relatively lower investment suggests that the company is under investing.

Earnings Quality

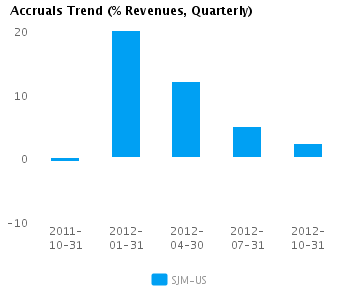

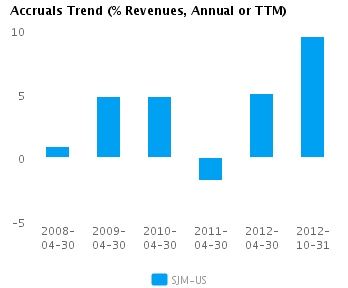

SJM-US’s net income margin for the last twelve months is around the peer median (8.2% vs. peer median of 8.2%). This average margin and relatively conservative accrual policy (9.5% vs. peer median of 4.0%) suggests possible understatement of its reported net income.

SJM-US’s accruals over the last twelve months are positive suggesting a buildup of reserves. In addition, the level of accrual is greater than the peer median — which suggests a relatively strong buildup in reserves compared to its peers.

Trend Charts

Company Profile

Disclaimer

The information presented in this report has been obtained from sources deemed to be reliable, but AnalytixInsight does not make any representation about the accuracy, completeness, or timeliness of this information. This report was produced by AnalytixInsight for informational purposes only and nothing contained herein should be construed as an offer to buy or sell or as a solicitation of an offer to buy or sell any security or derivative instrument. This report is current only as of the date that it was published and the opinions, estimates, ratings and other information may change without notice or publication. Past performance is no guarantee of future results. Prior to making an investment or other financial decision, please consult with your financial, legal and tax advisors. AnalytixInsight shall not be liable for any party’s use of this report. AnalytixInsight is not a broker-dealer and does not buy, sell, maintain a position, or make a market in any security referred to herein. One of the principal tenets for us at AnalytixInsight is that the best person to handle your finances is you. By your use of our services or by reading any our reports, you’re agreeing that you bear responsibility for your own investment research and investment decisions. You also agree that AnalytixInsight, its directors, its employees, and its agents will not be liable for any investment decision made or action taken by you and others based on news, information, opinion, or any other material generated by us and/or published through our services. For a complete copy of our disclaimer, please visit our website www.analytixinsight.com.

This article was originally written by abha.dawesar, and posted on CapitalCube.