Huntsman Corp.’s analysis versus peers uses the following peer-set: The Dow Chemical Company (NYSE:DOW), Eastman Chemical Company (NYSE:EMN), Ashland Inc. (NYSE:ASH), Rockwood Holdings, Inc. (NYSE:ROC), Cytec Industries Inc (NYSE:CYT), PolyOne Corporation (NYSE:POL) and Kronos Worldwide, Inc. (NYSE:KRO). The table below shows the preliminary results along with the recent trend for revenues, net income and returns.

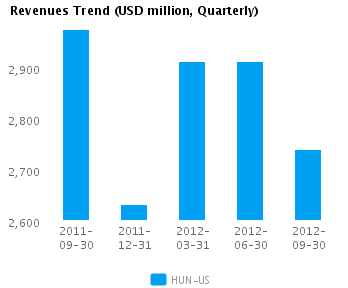

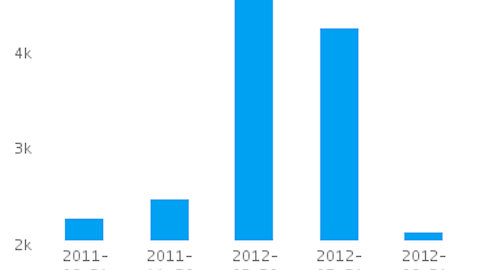

| Quarterly (USD million) | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 |

|---|---|---|---|---|---|

| Revenues | 2,741.0 | 2,914.0 | 2,913.0 | 2,632.0 | 2,976.0 |

| Revenue Growth % | (5.9) | 0.0 | 10.7 | (11.6) | 1.4 |

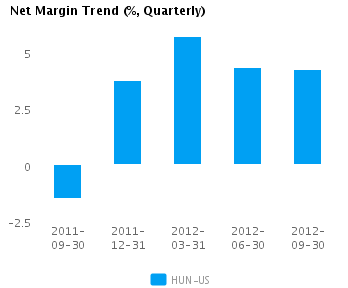

| Net Income | 116.0 | 126.0 | 167.0 | 99.0 | (44.0) |

| Net Income Growth % | (7.9) | (24.6) | 68.7 | N/A | (138.6) |

| Net Margin % | 4.2 | 4.3 | 5.7 | 3.8 | (1.5) |

| ROE % (Annualized) | 22.6 | 26.6 | 37.5 | 22.9 | (9.0) |

| ROA % (Annualized) | 5.3 | 5.7 | 7.6 | 4.5 | (1.9) |

Valuation Drivers

Huntsman Corp.’s current Price/Book of 1.7 is about median in its peer group. We classify HUN-US as Harvesting because of the market’s low expectations of growth (PE of 7.4 compared to peer median of 18.8) despite its relatively high returns (ROE of 25.3% compared to the peer median ROE of 18.5%).

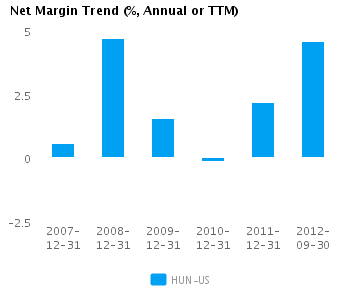

The company’s median net profit margins of 4.5% and relative asset efficiency (asset turns of 1.2x compared to peer median of 0.8x) give it some operating leverage. HUN-US’s net margin continues to trend upward and is now over one standard deviation above its five-year average net margin of 1.7%.

Economic Moat

HUN-US’s return on assets currently is around peer median (5.7% vs. peer median 4.9%) — similar to its returns over the past five years (2.1% vs. peer median 2.0%). This performance suggests that the company has no specific competitive advantages relative to its peers.

The company’s comparatively low gross margins of 21.8% versus peer median of 28.7% suggests that it has a non-differentiated strategy or is in a pricing constrained position. However, HUN-US’s pre-tax margin of 6.1% is around the peer median which, when combined with the gross margin, suggests lower operating costs relative to peers.

Growth & Investment Strategy

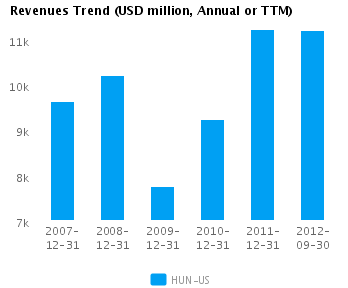

While HUN-US’s revenues growth has been above the peer median (3.2% vs. 1.8% respectively for the past three years), the stock’s PE ratio of 7.4 is less than the peer median. This implies that the company’s earnings are peaking and the market expects a decline in its growth expectations.

HUN-US’s annualized rate of change in capital of 0.7% over the past three years is less than its peer median of 7.6%. This below median investment level has also generated a less than peer median return on capital of 2.0% averaged over the same three years. This outcome suggests that the company has invested capital relatively poorly and now may be in maintenance mode.

Earnings Quality

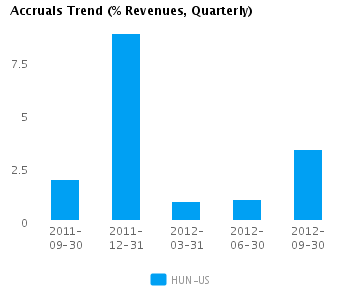

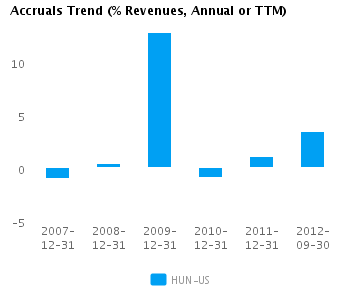

HUN-US’s net income margin for the last twelve months is around the peer median (4.5% vs. peer median of 5.1%). This average margin combined with a level of accruals that is around peer median (3.5% vs. peer median of 3.1%) suggests there possibly isn’t too much accrual movement flowing into the company’s reported earnings.

HUN-US’s accruals over the last twelve months are positive suggesting a buildup of reserves. However, this level of accruals is also around the peer median and suggests the company is recording a proper level of reserves compared to its peers.

Trend Charts