Worthington Industries, Inc. (NYSE:WOR) recently reported its preliminary financial results based on which we provide a unique peer-based analysis of the company. Our analysis is based on the company’s performance over the last twelve months (unless stated otherwise). For a more detailed analysis of this company (and over 40,000 other global equities) please visit www.capitalcube.com.

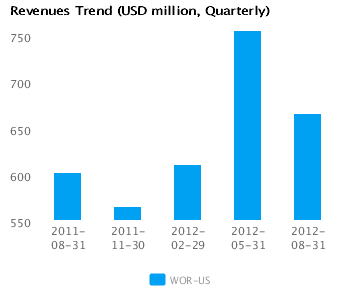

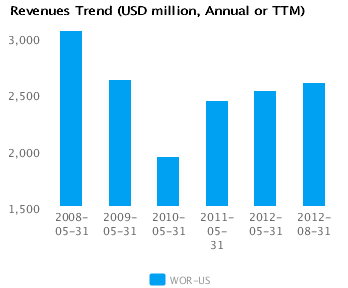

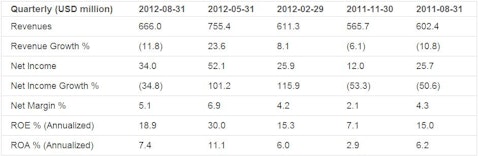

Worthington Industries Inc.’s analysis versus peers uses the following peer-set: Nucor Corporation (NYSE:NUE), Reliance Steel & Aluminum (NYSE:RS), United States Steel Corporation (NYSE:X), Carpenter Technology Corporation (NYSE:CRS), Steel Dynamics, Inc. (NASDAQ:STLD), Commercial Metals Company (NYSE:CMC), Schnitzer Steel Industries, Inc. (NASDAQ:SCHN) and AK Steel Holding Corporation (NYSE:AKS). The table below shows the preliminary results along with the recent trend for revenues, net income and returns.

Valuation Drivers

Worthington Industries Inc.’s current Price/Book of 2.1 is about median in its peer group. WOR-US’s operating performance is higher than the median of its chosen peers (ROE of 17.4% compared to the peer median ROE of 7.1%) but the market does not seem to expect higher growth relative to peers (PE of 12.6 compared to peer median of 15.6) but simply to maintain its relatively high rates of return.

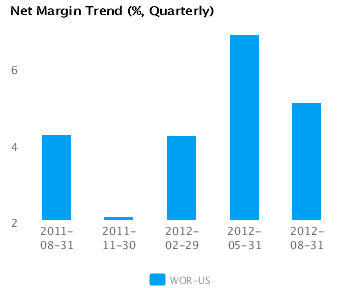

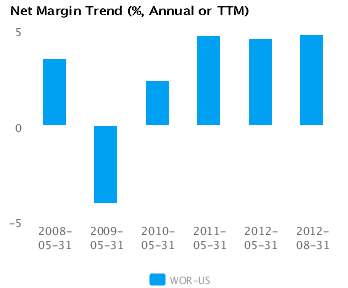

The company attempts to achieve high profit margins (currently 4.8% vs. peer median of 2.1%) through differentiated products. It currently operates with peer median asset turns of 1.5x. WOR-US’s net margin is its highest relative to the last four years and compares to a low of -4.1% in 2009.

Economic Moat

Changes in the company’s annual top line and earnings (3.8% and 0.5% respectively) generally lag its peers. This implies a lack of strategic focus and/or inability to execute. We view such companies as laggards relative to peers.

WOR-US’s current return on assets is better than its peer median (7.2% vs. peer median 3.5%) but this contrasts with its less than peer median return on assets over the past five years (3.2% vs. peer median 4.4%). This performance suggests that the company has improved its operations relative to peers.

The company’s comparatively healthy gross margin of 16.2% versus peer median of 11.2% suggests that it has a differentiated strategy with pricing advantages. Further, WOR-US’s bottom-line operating performance is better than peer median (pre-tax margins of 4.6% compared to peer median 3.1%) suggesting relatively tight control on operating costs.

Growth & Investment Strategy

While WOR-US’s revenues have grown faster than the peer median (-1.2% vs. -2.3% respectively for the past three years), the market gives the stock an about peer median PE ratio of 12.6. This suggests that the market has some questions about the company’s long-term strategy.

WOR-US’s annualized rate of change in capital of 9.2% over the past three years is higher than its peer median of 2.1%. This investment has generated an above peer median return on capital of 8.7% averaged over the same three years. Evidently, the relatively high capital investment was successful given the relatively strong growth in its returns.

Earnings Quality

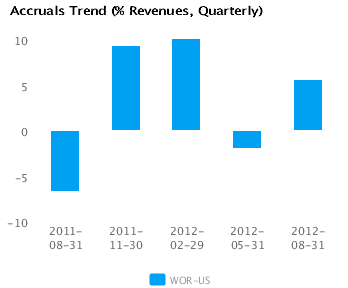

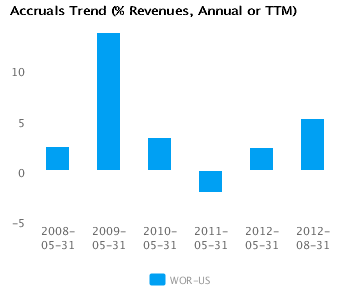

WOR-US has reported relatively strong net income margin for the last twelve months (4.8% vs. peer median of 2.1%). This margin performance combined with relatively high accruals (5.2% vs. peer median of 3.6%) suggests possible conservative accounting and an understatement of its reported net income.

WOR-US’s accruals over the last twelve months are positive suggesting a buildup of reserves. In addition, the level of accrual is greater than the peer median — which suggests a relatively strong buildup in reserves compared to its peers.

Trend Charts