After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30th. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Dollar Tree, Inc. (NASDAQ:DLTR).

Hedge fund interest in Dollar Tree, Inc. (NASDAQ:DLTR) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as T. Rowe Price Group, Inc. (NASDAQ:TROW), IHS Markit Ltd. (NYSE:INFO), and Hilton Worldwide Holdings Inc (NYSE:HLT) to gather more data points. Our calculations also showed that DLTR isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most shareholders, hedge funds are perceived as unimportant, old investment vehicles of yesteryear. While there are over 8000 funds with their doors open today, Our researchers look at the bigwigs of this group, around 750 funds. These money managers shepherd the lion’s share of the hedge fund industry’s total capital, and by shadowing their first-class picks, Insider Monkey has formulated a number of investment strategies that have historically outperformed Mr. Market. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a gander at the key hedge fund action surrounding Dollar Tree, Inc. (NASDAQ:DLTR).

What does smart money think about Dollar Tree, Inc. (NASDAQ:DLTR)?

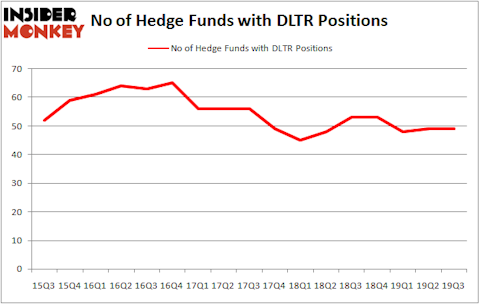

At the end of the third quarter, a total of 49 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards DLTR over the last 17 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Akre Capital Management held the most valuable stake in Dollar Tree, Inc. (NASDAQ:DLTR), which was worth $580.6 million at the end of the third quarter. On the second spot was Rivulet Capital which amassed $163.8 million worth of shares. Renaissance Technologies, Millennium Management, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Rivulet Capital allocated the biggest weight to Dollar Tree, Inc. (NASDAQ:DLTR), around 18.58% of its portfolio. Sunriver Management is also relatively very bullish on the stock, designating 6.94 percent of its 13F equity portfolio to DLTR.

Seeing as Dollar Tree, Inc. (NASDAQ:DLTR) has experienced bearish sentiment from the smart money, logic holds that there exists a select few funds that slashed their positions entirely in the third quarter. It’s worth mentioning that Jeffrey Smith’s Starboard Value LP dumped the largest stake of the “upper crust” of funds followed by Insider Monkey, totaling close to $59.7 million in stock. Oscar Hattink’s fund, BlueDrive Global Investors, also sold off its stock, about $27.5 million worth. These moves are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Dollar Tree, Inc. (NASDAQ:DLTR). We will take a look at T. Rowe Price Group, Inc. (NASDAQ:TROW), IHS Markit Ltd. (NYSE:INFO), Hilton Worldwide Holdings Inc (NYSE:HLT), and Sun Life Financial Inc. (NYSE:SLF). This group of stocks’ market valuations match DLTR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TROW | 23 | 209393 | -7 |

| INFO | 30 | 859361 | 2 |

| HLT | 48 | 3928940 | 4 |

| SLF | 12 | 259612 | 1 |

| Average | 28.25 | 1314327 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.25 hedge funds with bullish positions and the average amount invested in these stocks was $1314 million. That figure was $1912 million in DLTR’s case. Hilton Worldwide Holdings Inc (NYSE:HLT) is the most popular stock in this table. On the other hand Sun Life Financial Inc. (NYSE:SLF) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Dollar Tree, Inc. (NASDAQ:DLTR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately DLTR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on DLTR were disappointed as the stock returned -4.5% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.