Artisan Partners, an investment management company, released its “Artisan Mid Cap Fund” fourth quarter 2023 investor letter. A copy of the same can be downloaded here. The final quarter of 2023 saw a continuous fluctuation between recessionary fears and soft-landing optimism. In the fourth quarter, the fund’s Investor Class fund ARTMX returned 8.86%, Advisor Class fund APDMX posted a return of 8.93%, and Institutional Class fund APHMX returned 8.96%, compared to a 14.55% return for the Russell Midcap Growth Index. The portfolio generated a positive absolute return in Q4 but underperformed the Russell Midcap Growth Index due to poor security selection, particularly in health care and information technology. In addition, please check the fund’s top five holdings to know its best picks in 2023.

Artisan Mid Cap Fund featured stocks like Jabil Inc. (NYSE:JBL) in the Q3 2023 investor letter. Headquartered in Saint Petersburg, Florida, Jabil Inc. (NYSE:JBL) offers manufacturing services and solutions. On March 6, 2024, Jabil Inc. (NYSE:JBL) stock closed at $153.19 per share. One-month return of Jabil Inc. (NYSE:JBL) was 12.70%, and its shares gained 83.75% of their value over the last 52 weeks. Jabil Inc. (NYSE:JBL) has a market capitalization of $19.539 billion.

Artisan Mid Cap Fund stated the following regarding Jabil Inc. (NYSE:JBL) in its fourth quarter 2023 investor letter:

“Along with DexCom, notable adds in the quarter included Quanta Services and Jabil Inc. (NYSE:JBL). Jabil provides outsourced manufacturing services to a diverse set of end markets and customers. For two decades, Jabil focused on manufacturing to customer-specified blueprints, which inherently carried low margins (2%–3%), a problem further exacerbated by Asian competition. However, in 2017, Jabil commenced a strategic pivot to focus on manufacturing high-growth, low-volume and high-value products in areas such as health care, industrial, automotive, cloud and 5G infrastructure. We believe moving away from more cyclical consumer electronics markets toward secular growth areas, such as EVs and medical devices, will lead to both faster growth and higher margins. Like other electronic components providers, Jabil saw slowing demand late in the year and lowered its fiscal 2024 outlook as a result. However, consistent with our thesis that Jabil has shifted its business mix toward more profitable, higher growth end markets, the company’s earnings and cash flow outlook remains relatively strong despite the cyclical pressures. Furthermore, the company sold its smartphone manufacturing business late in the quarter, which removes a low-growth, low-margin legacy exposure, further shifting its business mix in the right direction. We used the stock’s underperformance to increase our GardenSM position ahead of what we expect to be a compelling profit cycle once the current macro headwinds abate.”

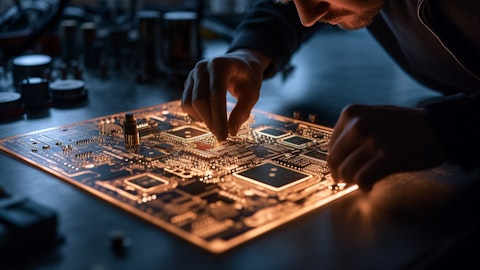

A technician overseeing an application-specific integrated circuit design, etched on a metallic plate.

Jabil Inc. (NYSE:JBL) is not on our list of 30 Most Popular Stocks Among Hedge Funds. At the end of the fourth quarter, Jabil Inc. (NYSE:JBL) was held by 35 hedge fund portfolios, compared to 35 in the previous quarter, according to our database.

We discussed Jabil Inc. (NYSE:JBL) in another article and shared the list of best electronic stocks to buy. In addition, please check out our hedge fund investor letters Q4 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 20 Most Expensive Tequilas in the World

- 15 Most Expensive Mail Newsletters to Subscribe To

- 20 Biggest Oil Producers in the World

Disclosure: None. This article is originally published at Insider Monkey.