The SEC requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings discloses the funds’ positions on September 30. We at Insider Monkey have compiled an extensive database of more than 700 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Air Products & Chemicals, Inc. (NYSE:APD) based on those filings.

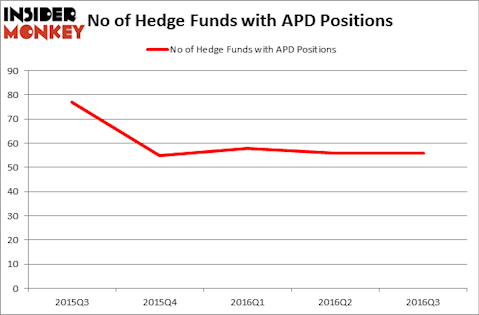

Air Products & Chemicals, Inc. (NYSE:APD) shares haven’t seen a lot of action during the third quarter, as the hedge fund sentiment was unchanged and the stock was included in the portfolios of 56 funds tracked by us at the end of September. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Wipro Limited (ADR) (NYSE:WIT), Liberty Global PLC LiLAC Class A (NASDAQ:LILA), and IntercontinentalExchange Inc (NYSE:ICE) to gather more data points.

Follow Air Products & Chemicals Inc. (NYSE:APD)

Follow Air Products & Chemicals Inc. (NYSE:APD)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

SpaceKris /Shutterstock.com

With all of this in mind, we’re going to take a look at the key action surrounding Air Products & Chemicals, Inc. (NYSE:APD).

What does the smart money think about Air Products & Chemicals, Inc. (NYSE:APD)?

A total of 56 funds tracked by Insider Monkey were bullish on Air Products & Chemicals, Inc. (NYSE:APD) at the end of September. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Viking Global, managed by Andreas Halvorsen, holds the most valuable position in Air Products & Chemicals, Inc. (NYSE:APD). Viking Global has a $725 million position in the stock, comprising 3.1% of its 13F portfolio. The second largest stake is held by Pershing Square, managed by Bill Ackman, which holds a $605.1 million position; 11.2% of its 13F portfolio is allocated to the company. Remaining peers that are bullish include Daniel S. Och’s OZ Management, William B. Gray’s Orbis Investment Management and Phill Gross and Robert Atchinson’s Adage Capital Management.