Artisan Partners, an investment management company, released its “Artisan Mid Cap Fund” first quarter 2023 investor letter. A copy of the same can be downloaded here. In the first quarter, its Investor Class fund ARTMX returned 12.37%, Advisor Class fund APDMX posted a return of 12.43%, and Institutional Class fund APHMX returned 12.43%, compared to a 9.14% return for the Russell Midcap Growth Index. Positive stock selection drove the portfolio to outperform in the quarter and was most pronounced in the information technology and healthcare sector. In addition, please check the fund’s top five holdings to know its best picks in 2023.

Artisan Mid Cap Fund highlighted stocks like Bentley Systems, Incorporated (NASDAQ:BSY) in the first quarter 2023 investor letter. Headquartered in Exton, Pennsylvania, Bentley Systems, Incorporated (NASDAQ:BSY) is an infrastructure engineering software solutions provider. On June 21, 2023, Bentley Systems, Incorporated (NASDAQ:BSY) stock closed at $52.58 per share. One-month return of Bentley Systems, Incorporated (NASDAQ:BSY) was 10.76%, and its shares gained 52.76% of their value over the last 52 weeks. Bentley Systems, Incorporated (NASDAQ:BSY) has a market capitalization of $15.426 billion.

Artisan Mid Cap Fund made the following comment about Bentley Systems, Incorporated (NASDAQ:BSY) in its first quarter 2023 investor letter:

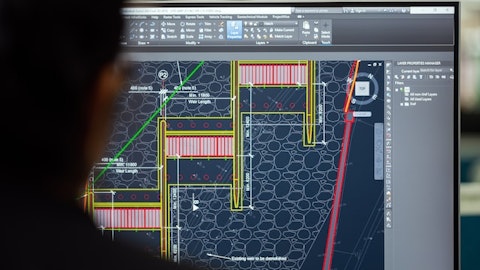

“Notable adds in the quarter included Verisk Analytics, Bentley Systems, Incorporated (NASDAQ:BSY) and Arthur J. Gallagher. Bentley Systems is the leading provider of engineering software used to design roads, bridges, tunnels, rail systems and other public works. Construction is one of the least digitized verticals of the economy, and there are significant opportunities for software to increase the productivity of civil engineering projects. Business momentum is strengthening, and we view Bentley as well positioned to support the infrastructure spending that’s encouraged by the Infrastructure Investment and Jobs Act and Inflation Reduction Act. Civil engineers may prove hard pressed to respond to accelerating project opportunities under these market conditions, further enhancing the importance of Bentley’s design tools. At a time when growth rates in software are generally seeing pressure, we believe this company has the potential to maintain its current pace, or even accelerate slightly, into 2023 given this backdrop.”

Photo by ThisisEngineering RAEng on Unsplash

Bentley Systems, Incorporated (NASDAQ:BSY) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 19 hedge fund portfolios held Bentley Systems, Incorporated (NASDAQ:BSY) at the end of first quarter 2023 which was 24 in the previous quarter.

We discussed Bentley Systems, Incorporated (NASDAQ:BSY) in another article and shared Conestoga Mid Cap Strategy’s views on the company. In addition, please check out our hedge fund investor letters Q1 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- Top 15 Grain Producing Countries in the World

- 20 Worst Performing S&P 500 Stocks in 2023

- Top 20 Manufacturing Countries in the World

Disclosure: None. This article is originally published at Insider Monkey.