The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Westmoreland Coal Company (NASDAQ:WLB) .

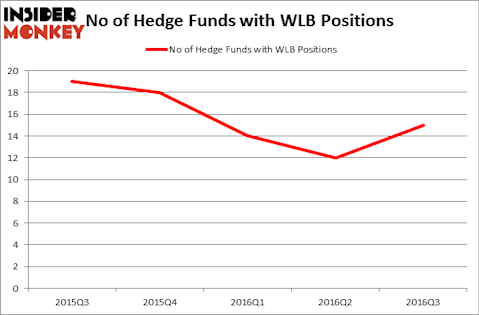

Westmoreland Coal Company (NASDAQ:WLB) shareholders have witnessed an increase in hedge fund interest of late. There were 12 hedge funds in our database with WLB holdings at the end of the previous quarter. At the end of this article we will also compare WLB to other stocks including KEMET Corporation (NYSE:KEM), Dawson Geophysical Company (NASDAQ:DWSN), and JTH Holding Inc (NASDAQ:TAX) to get a better sense of its popularity.

Follow Westmoreland Coal Co (NASDAQ:WLB)

Follow Westmoreland Coal Co (NASDAQ:WLB)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

abstractdesignlabs/Shutterstock.com

Keeping this in mind, we’re going to take a look at the new action surrounding Westmoreland Coal Company (NASDAQ:WLB).

What does the smart money think about Westmoreland Coal Company (NASDAQ:WLB)?

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards WLB over the last 5 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Nathaniel August’s Mangrove Partners has the biggest position in Westmoreland Coal Company (NASDAQ:WLB), worth close to $16.8 million, corresponding to 3.9% of its total 13F portfolio. Sitting at the No. 2 spot is Jeffrey Bersh and Michael Wartell of Venor Capital Management, with a $11.5 million position; the fund has 16.6% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions contain Jeffrey Gendell’s Tontine Asset Management, Andy Rebak and Michael Scott’s Farmstead Capital Management and D E Shaw, one of the biggest hedge funds in the world. We should note that Mangrove Partners is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.