We can judge whether Twenty-First Century Fox Inc (NASDAQ:FOX) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, research shows that these picks historically outperformed the market when we factor in known risk factors.

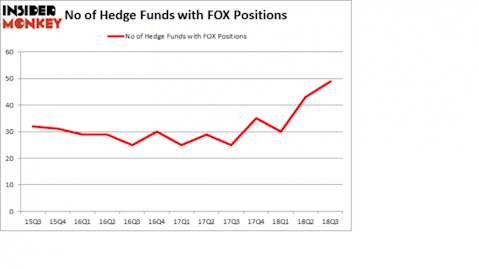

Twenty-First Century Fox Inc (NASDAQ:FOX) was in 49 hedge funds’ portfolios at the end of September. FOX investors should pay attention to an increase in support from the world’s most elite money managers of late. There were 43 hedge funds in our database with FOX positions at the end of the previous quarter. Our calculations also showed that FOX isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a peek at the fresh hedge fund action regarding Twenty-First Century Fox Inc (NASDAQ:FOX).

Hedge fund activity in Twenty-First Century Fox Inc (NASDAQ:FOX)

Heading into the fourth quarter of 2018, a total of 49 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from one quarter earlier. On the other hand, there were a total of 35 hedge funds with a bullish position in FOX at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Consequently, key hedge funds have jumped into Twenty-First Century Fox Inc (NASDAQ:FOX) headfirst. 3G Capital, managed by Jorge Paulo Lemann, created the most outsized position in Twenty-First Century Fox Inc (NASDAQ:FOX). 3G Capital had $130.4 million invested in the company at the end of the quarter. Robert Pohly’s Samlyn Capital also made a $124 million investment in the stock during the quarter. The other funds with brand new FOX positions are Isaac Corre’s Governors Lane, Shane Finemore’s Manikay Partners, and Steve Pigott’s Fort Baker Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Twenty-First Century Fox Inc (NASDAQ:FOX). These stocks are The Goldman Sachs Group, Inc. (NYSE:GS), Schlumberger Limited. (NYSE:SLB), Morgan Stanley (NYSE:MS), and Banco Santander, S.A. (NYSE:SAN). This group of stocks’ market caps are similar to FOX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GS | 57 | 6876991 | -4 |

| SLB | 55 | 1514319 | 12 |

| MS | 51 | 4642452 | 2 |

| SAN | 19 | 754414 | -1 |

| Average | 45.5 | 3447044 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 45.5 hedge funds with bullish positions and the average amount invested in these stocks was $3.45 billion. That figure was $5.34 billion in FOX’s case. Goldman Sachs Group, Inc. (NYSE:GS) is the most popular stock in this table. On the other hand Banco Santander, S.A. (NYSE:SAN) is the least popular one with only 19 bullish hedge fund positions. Twenty-First Century Fox Inc (NASDAQ:FOX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard GS might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.