As we already know from media reports and hedge fund investor letters, many hedge funds lost money in October, blaming macroeconomic conditions and unpredictable events that hit several sectors, with healthcare among them. Nevertheless, most investors decided to stick to their bullish theses and their long-term focus allows us to profit from the recent declines. In particular, let’s take a look at what hedge funds think about Spectrum Brands Holdings, Inc. (NYSE:SPB) in this article.

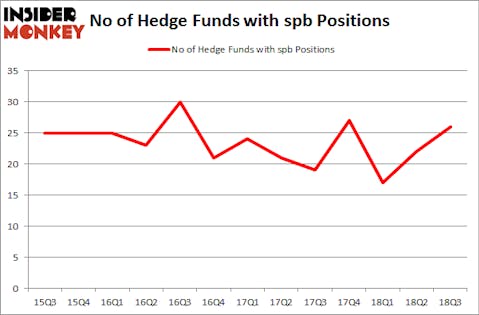

Is Spectrum Brands Holdings, Inc. (NYSE:SPB) a buy right now? The smart money is taking a bullish view. The number of bullish hedge fund positions went up by 4 lately. Our calculations also showed that spb isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are a large number of methods stock market investors employ to assess stocks. A duo of the most useful methods are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the top money managers can beat the market by a solid amount (see the details here).

Let’s take a peek at the key hedge fund action regarding Spectrum Brands Holdings, Inc. (NYSE:SPB).

How have hedgies been trading Spectrum Brands Holdings, Inc. (NYSE:SPB)?

At Q3’s end, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a change of 18% from one quarter earlier. On the other hand, there were a total of 27 hedge funds with a bullish position in SPB at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Leucadia National was the largest shareholder of Spectrum Brands Holdings, Inc. (NYSE:SPB), with a stake worth $561.5 million reported as of the end of September. Trailing Leucadia National was Cardinal Capital, which amassed a stake valued at $67.8 million. Citadel Investment Group, Governors Lane, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, key hedge funds were breaking ground themselves. Leucadia National, managed by Ian Cumming and Joseph Steinberg, initiated the largest position in Spectrum Brands Holdings, Inc. (NYSE:SPB). Leucadia National had $561.5 million invested in the company at the end of the quarter. Amy Minella’s Cardinal Capital also made a $67.8 million investment in the stock during the quarter. The following funds were also among the new SPB investors: Ken Griffin’s Citadel Investment Group, Isaac Corre’s Governors Lane, and Israel Englander’s Millennium Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Spectrum Brands Holdings, Inc. (NYSE:SPB) but similarly valued. We will take a look at TCF Financial Corporation (NYSE:TCF), Amedisys Inc (NASDAQ:AMED), iShares MSCI All Country Asia ex Jpn ETF (NASDAQ:AAXJ), and Silicon Laboratories Inc. (NASDAQ:SLAB). This group of stocks’ market valuations match SPB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TCF | 24 | 308162 | 9 |

| AMED | 20 | 140171 | 5 |

| AAXJ | 1 | 1786 | -2 |

| SLAB | 14 | 73412 | 1 |

| Average | 14.75 | 130883 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $131 million. That figure was $915 million in SPB’s case. TCF Financial Corporation (NYSE:TCF) is the most popular stock in this table. On the other hand iShares MSCI All Country Asia ex Japan Index Fund (NASDAQ:AAXJ) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Spectrum Brands Holdings, Inc. (NYSE:SPB) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.