Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 900 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Revlon Inc (NYSE:REV) in this article.

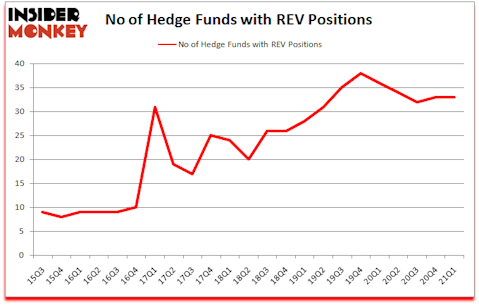

Revlon Inc (NYSE:REV) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 33 hedge funds’ portfolios at the end of the first quarter of 2021. Our calculations also showed that REV isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings). At the end of this article we will also compare REV to other stocks including PLBY Group, Inc. (NASDAQ:PLBY), Flushing Financial Corporation (NASDAQ:FFIC), and Heritage-Crystal Clean, Inc. (NASDAQ:HCCI) to get a better sense of its popularity.

In the eyes of most investors, hedge funds are perceived as slow, outdated financial tools of years past. While there are more than 8000 funds with their doors open at the moment, Our experts choose to focus on the crème de la crème of this club, around 850 funds. These investment experts command bulk of the smart money’s total asset base, and by shadowing their unrivaled stock picks, Insider Monkey has unsheathed various investment strategies that have historically surpassed the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Henrik Rhenman of Rhenman & Partners Asset Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s review the fresh hedge fund action encompassing Revlon Inc (NYSE:REV).

Do Hedge Funds Think REV Is A Good Stock To Buy Now?

At the end of the first quarter, a total of 33 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards REV over the last 23 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

More specifically, Pzena Investment Management was the largest shareholder of Revlon Inc (NYSE:REV), with a stake worth $82.2 million reported as of the end of March. Trailing Pzena Investment Management was SQN Investors, which amassed a stake valued at $42.3 million. Praesidium Investment Management Company, Sectoral Asset Management, and Pura Vida Investments were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position SCW Capital Management allocated the biggest weight to Revlon Inc (NYSE:REV), around 11.3% of its 13F portfolio. P.A.W. CAPITAL PARTNERS is also relatively very bullish on the stock, designating 2.39 percent of its 13F equity portfolio to REV.

Since Revlon Inc (NYSE:REV) has faced falling interest from hedge fund managers, it’s easy to see that there lies a certain “tier” of hedgies that slashed their entire stakes by the end of the first quarter. Interestingly, Will Cook’s Sunriver Management dropped the biggest position of the “upper crust” of funds followed by Insider Monkey, valued at close to $14.2 million in stock, and Jamie Zimmerman’s Litespeed Management was right behind this move, as the fund cut about $11.5 million worth. These transactions are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Revlon Inc (NYSE:REV). We will take a look at PLBY Group, Inc. (NASDAQ:PLBY), Flushing Financial Corporation (NASDAQ:FFIC), Heritage-Crystal Clean, Inc. (NASDAQ:HCCI), Dorian LPG Ltd (NYSE:LPG), Tarsus Pharmaceuticals, Inc. (NASDAQ:TARS), Chinook Therapeutics, Inc. (NASDAQ:KDNY), and Beazer Homes USA, Inc. (NYSE:BZH). This group of stocks’ market valuations are closest to REV’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PLBY | 13 | 56101 | 13 |

| FFIC | 11 | 42985 | 1 |

| HCCI | 10 | 69425 | -2 |

| LPG | 18 | 99388 | 4 |

| TARS | 8 | 267023 | 2 |

| KDNY | 15 | 189590 | 0 |

| BZH | 12 | 26820 | 2 |

| Average | 12.4 | 107333 | 2.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.4 hedge funds with bullish positions and the average amount invested in these stocks was $107 million. That figure was $358 million in REV’s case. Dorian LPG Ltd (NYSE:LPG) is the most popular stock in this table. On the other hand Tarsus Pharmaceuticals, Inc. (NASDAQ:TARS) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Revlon Inc (NYSE:REV) is more popular among hedge funds. Our overall hedge fund sentiment score for REV is 81.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 22.8% in 2021 through July 2nd and still beat the market by 6 percentage points. Unfortunately REV wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on REV were disappointed as the stock returned 1.1% since the end of the first quarter (through 7/2) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Revlon Inc (OTC:REVRQ)

Follow Revlon Inc (OTC:REVRQ)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 25 best places to live in the u.s. for families

- 10 Best Dividend Stocks to Buy for Long Term Gains

Disclosure: None. This article was originally published at Insider Monkey.