Will the new coronavirus cause a recession in US in the next 6 months? On February 27th, we put the probability at 75% and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Perspecta Inc. (NYSE:PRSP).

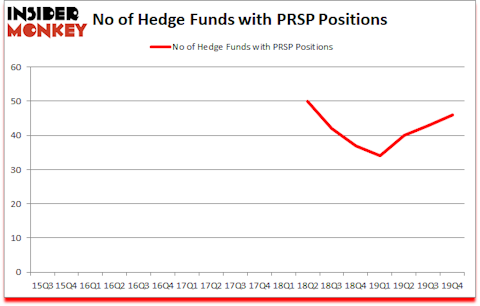

Perspecta Inc. (NYSE:PRSP) investors should be aware of an increase in activity from the world’s largest hedge funds lately. PRSP was in 46 hedge funds’ portfolios at the end of December. There were 43 hedge funds in our database with PRSP positions at the end of the previous quarter. Our calculations also showed that PRSP isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Lee Ainslie of Maverick Capital

Keeping this in mind let’s analyze the new hedge fund action surrounding Perspecta Inc. (NYSE:PRSP).

What have hedge funds been doing with Perspecta Inc. (NYSE:PRSP)?

At Q4’s end, a total of 46 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from the third quarter of 2019. The graph below displays the number of hedge funds with bullish position in PRSP over the last 18 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Maverick Capital held the most valuable stake in Perspecta Inc. (NYSE:PRSP), which was worth $142.2 million at the end of the third quarter. On the second spot was Dorsal Capital Management which amassed $46.5 million worth of shares. D E Shaw, Crescent Park Management, and Renaissance Technologies were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Bodenholm Capital allocated the biggest weight to Perspecta Inc. (NYSE:PRSP), around 24.61% of its 13F portfolio. Crescent Park Management is also relatively very bullish on the stock, designating 7.83 percent of its 13F equity portfolio to PRSP.

Consequently, key hedge funds were breaking ground themselves. Voleon Capital, managed by Michael Kharitonov and Jon David McAuliffe, established the most valuable position in Perspecta Inc. (NYSE:PRSP). Voleon Capital had $1.8 million invested in the company at the end of the quarter. Qing Li’s Sciencast Management also initiated a $1 million position during the quarter. The other funds with brand new PRSP positions are Andre F. Perold’s HighVista Strategies, Matthew Tewksbury’s Stevens Capital Management, and Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors.

Let’s now review hedge fund activity in other stocks similar to Perspecta Inc. (NYSE:PRSP). We will take a look at YY Inc (NASDAQ:YY), Angie’s List Inc (NASDAQ:ANGI), Sterling Bancorp (NYSE:STL), and Spire Inc. (NYSE:SR). All of these stocks’ market caps resemble PRSP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| YY | 23 | 143195 | 6 |

| ANGI | 23 | 386770 | 0 |

| STL | 30 | 337941 | 5 |

| SR | 12 | 55236 | -2 |

| Average | 22 | 230786 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $231 million. That figure was $599 million in PRSP’s case. Sterling Bancorp (NYSE:STL) is the most popular stock in this table. On the other hand Spire Inc. (NYSE:SR) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Perspecta Inc. (NYSE:PRSP) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 17.4% in 2020 through March 25th and still beat the market by 5.5 percentage points. Unfortunately PRSP wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PRSP were disappointed as the stock returned -32.3% during the first two and a half months of 2020 (through March 25th) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market in Q1.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.