It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 20 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated an outperformance of 6 percentage points during the first 5 months of 2019. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Pattern Energy Group Inc (NASDAQ:PEGI).

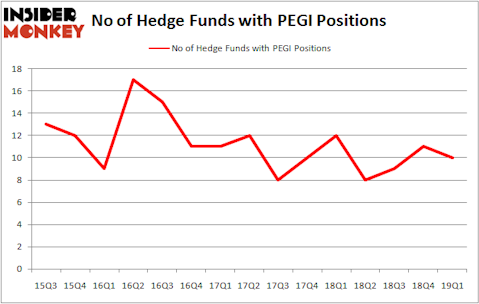

Is Pattern Energy Group Inc (NASDAQ:PEGI) a bargain? The smart money is getting less optimistic. The number of bullish hedge fund positions dropped by 1 lately. Our calculations also showed that PEGI isn’t among the 30 most popular stocks among hedge funds.

To most shareholders, hedge funds are viewed as underperforming, old financial vehicles of the past. While there are over 8000 funds with their doors open today, Our researchers look at the masters of this group, about 750 funds. These hedge fund managers handle the majority of all hedge funds’ total asset base, and by watching their unrivaled investments, Insider Monkey has discovered several investment strategies that have historically surpassed the market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Paul Marshall of Marshall Wace

We’re going to review the new hedge fund action encompassing Pattern Energy Group Inc (NASDAQ:PEGI).

What have hedge funds been doing with Pattern Energy Group Inc (NASDAQ:PEGI)?

At Q1’s end, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of -9% from the previous quarter. By comparison, 12 hedge funds held shares or bullish call options in PEGI a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, GLG Partners, managed by Noam Gottesman, holds the number one position in Pattern Energy Group Inc (NASDAQ:PEGI). GLG Partners has a $14.1 million position in the stock, comprising 0.1% of its 13F portfolio. Sitting at the No. 2 spot is Matthew Hulsizer of PEAK6 Capital Management, with a $7.6 million call position; less than 0.1%% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors that hold long positions contain Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and D. E. Shaw’s D E Shaw.

Due to the fact that Pattern Energy Group Inc (NASDAQ:PEGI) has faced falling interest from the entirety of the hedge funds we track, it’s easy to see that there exists a select few money managers that elected to cut their entire stakes last quarter. Intriguingly, Steve Cohen’s Point72 Asset Management cut the biggest investment of the 700 funds monitored by Insider Monkey, comprising close to $0.7 million in stock. Richard Driehaus’s fund, Driehaus Capital, also cut its stock, about $0.7 million worth. These moves are important to note, as total hedge fund interest fell by 1 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Pattern Energy Group Inc (NASDAQ:PEGI) but similarly valued. These stocks are Intelsat S.A. (NYSE:I), InterDigital, Inc. (NASDAQ:IDCC), Mantech International Corp (NASDAQ:MANT), and Lithia Motors Inc (NYSE:LAD). This group of stocks’ market valuations resemble PEGI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| I | 54 | 733520 | 12 |

| IDCC | 16 | 172766 | -5 |

| MANT | 12 | 16915 | 2 |

| LAD | 17 | 536544 | -3 |

| Average | 24.75 | 364936 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.75 hedge funds with bullish positions and the average amount invested in these stocks was $365 million. That figure was $25 million in PEGI’s case. Intelsat S.A. (NYSE:I) is the most popular stock in this table. On the other hand Mantech International Corp (NASDAQ:MANT) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Pattern Energy Group Inc (NASDAQ:PEGI) is even less popular than MANT. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on PEGI, though not to the same extent, as the stock returned 4.5% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.