Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track more than 700 prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ recent losses in Facebook. Let’s take a closer look at what the funds we track think about Oasis Petroleum Inc. (NYSE:OAS) in this article.

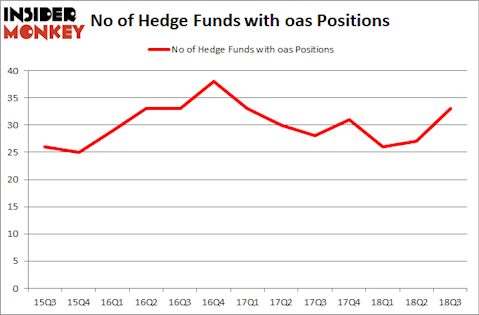

Oasis Petroleum Inc. (NYSE:OAS) shareholders have witnessed an increase in enthusiasm from smart money of late. Our calculations also showed that oas isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are a multitude of indicators market participants use to grade stocks. A couple of the most innovative indicators are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the top fund managers can outclass the market by a superb margin (see the details here).

Let’s check out the recent hedge fund action surrounding Oasis Petroleum Inc. (NYSE:OAS).

Hedge fund activity in Oasis Petroleum Inc. (NYSE:OAS)

At the end of the third quarter, a total of 33 of the hedge funds tracked by Insider Monkey were long this stock, a change of 22% from the previous quarter. By comparison, 31 hedge funds held shares or bullish call options in OAS heading into this year. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, GMT Capital, managed by Thomas E. Claugus, holds the number one position in Oasis Petroleum Inc. (NYSE:OAS). GMT Capital has a $203.4 million position in the stock, comprising 5.3% of its 13F portfolio. Coming in second is Ken Griffin of Citadel Investment Group, with a $167.4 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions contain Israel Englander’s Millennium Management, John Labanowski’s Brenham Capital Management and Daniel Arbess’s Perella Weinberg Partners.

As industrywide interest jumped, key money managers were leading the bulls’ herd. Key Square Capital Management, managed by Scott Bessent, established the most outsized position in Oasis Petroleum Inc. (NYSE:OAS). Key Square Capital Management had $13.6 million invested in the company at the end of the quarter. Clint Carlson’s Carlson Capital also initiated a $12.2 million position during the quarter. The following funds were also among the new OAS investors: Guy Shahar’s DSAM Partners, Mike Vranos’s Ellington, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s go over hedge fund activity in other stocks similar to Oasis Petroleum Inc. (NYSE:OAS). We will take a look at Pilgrim’s Pride Corporation (NASDAQ:PPC), Teradata Corporation (NYSE:TDC), Medidata Solutions Inc (NASDAQ:MDSO), and Agios Pharmaceuticals Inc (NASDAQ:AGIO). This group of stocks’ market valuations are closest to OAS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PPC | 16 | 105876 | 2 |

| TDC | 23 | 254471 | 2 |

| MDSO | 14 | 136899 | 3 |

| AGIO | 22 | 372204 | -1 |

| Average | 18.75 | 217363 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $217 million. That figure was $940 million in OAS’s case. Teradata Corporation (NYSE:TDC) is the most popular stock in this table. On the other hand Medidata Solutions Inc (NASDAQ:MDSO) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Oasis Petroleum Inc. (NYSE:OAS) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.