Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

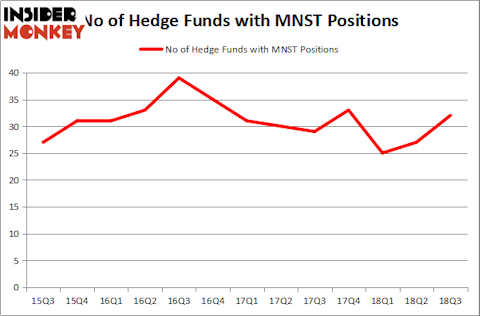

Is Monster Beverage Corp (NASDAQ:MNST) worth your attention right now? Money managers are getting more optimistic. The number of long hedge fund bets rose by 5 lately. Our calculations also showed that MNST isn’t among the 30 most popular stocks among hedge funds. MNST was in 32 hedge funds’ portfolios at the end of September. There were 27 hedge funds in our database with MNST positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s analyze the fresh hedge fund action encompassing Monster Beverage Corp (NASDAQ:MNST).

Hedge fund activity in Monster Beverage Corp (NASDAQ:MNST)

Heading into the fourth quarter of 2018, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 19% from the previous quarter. On the other hand, there were a total of 33 hedge funds with a bullish position in MNST at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Neal C. Bradsher’s Broadwood Capital has the largest position in Monster Beverage Corp (NASDAQ:MNST), worth close to $278.2 million, comprising 25.8% of its total 13F portfolio. Sitting at the No. 2 spot is Tybourne Capital Management, led by Eashwar Krishnan, holding a $226 million position; the fund has 9.7% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions consist of John Overdeck and David Siegel’s Two Sigma Advisors, D. E. Shaw’s D E Shaw and Jim Simons’s Renaissance Technologies.

As aggregate interest increased, key hedge funds have jumped into Monster Beverage Corp (NASDAQ:MNST) headfirst. Stevens Capital Management, managed by Matthew Tewksbury, assembled the largest position in Monster Beverage Corp (NASDAQ:MNST). Stevens Capital Management had $9.2 million invested in the company at the end of the quarter. Lee Ainslie’s Maverick Capital also made a $6.7 million investment in the stock during the quarter. The other funds with new positions in the stock are Paul Tudor Jones’s Tudor Investment Corp, Ray Dalio’s Bridgewater Associates, and Jeffrey Talpins’s Element Capital Management.

Let’s check out hedge fund activity in other stocks similar to Monster Beverage Corp (NASDAQ:MNST). These stocks are Keurig Dr Pepper Inc. (NYSE:KDP), Moody’s Corporation (NYSE:MCO), Thomson Reuters Corporation (NYSE:TRI), and State Street Corporation (NYSE:STT). This group of stocks’ market values are closest to MNST’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KDP | 25 | 898629 | 5 |

| MCO | 35 | 5872297 | 5 |

| TRI | 24 | 391841 | 10 |

| STT | 35 | 1268343 | -1 |

| Average | 29.75 | 2107778 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.75 hedge funds with bullish positions and the average amount invested in these stocks was $2.11 billion. That figure was $1.21 billion in MNST’s case. Moody’s Corporation (NYSE:MCO) is the most popular stock in this table. On the other hand Thomson Reuters Corporation (NYSE:TRI) is the least popular one with only 24 bullish hedge fund positions. Monster Beverage Corp (NASDAQ:MNST) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MCO might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.