The Insider Monkey team has completed processing the quarterly 13F filings for the March quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Meritor Inc (NYSE:MTOR).

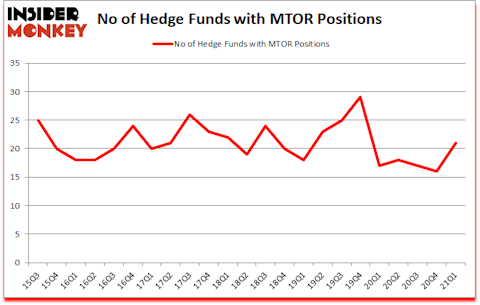

Is Meritor Inc (NYSE:MTOR) a buy here? Prominent investors were becoming more confident. The number of bullish hedge fund positions increased by 5 in recent months. Meritor Inc (NYSE:MTOR) was in 21 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 29. Our calculations also showed that MTOR isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 115 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Larry Robbins of Glenview Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, Chuck Schumer recently stated that marijuana legalization will be a Senate priority. So, we are checking out this under the radar stock that will benefit from this. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s analyze the recent hedge fund action encompassing Meritor Inc (NYSE:MTOR).

Do Hedge Funds Think MTOR Is A Good Stock To Buy Now?

At the end of March, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 31% from the fourth quarter of 2020. The graph below displays the number of hedge funds with bullish position in MTOR over the last 23 quarters. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the number one position in Meritor Inc (NYSE:MTOR). Royce & Associates has a $35.7 million position in the stock, comprising 0.2% of its 13F portfolio. Sitting at the No. 2 spot is Larry Robbins of Glenview Capital, with a $31.6 million position; 0.5% of its 13F portfolio is allocated to the stock. Other peers that hold long positions comprise Israel Englander’s Millennium Management, Mark Coe’s Intrinsic Edge Capital and Jacob Doft’s Highline Capital Management. In terms of the portfolio weights assigned to each position Highline Capital Management allocated the biggest weight to Meritor Inc (NYSE:MTOR), around 6.51% of its 13F portfolio. Intrinsic Edge Capital is also relatively very bullish on the stock, dishing out 0.68 percent of its 13F equity portfolio to MTOR.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. Athanor Capital, managed by Parvinder Thiara, established the most outsized position in Meritor Inc (NYSE:MTOR). Athanor Capital had $8.3 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $2.1 million position during the quarter. The other funds with new positions in the stock are Dmitry Balyasny’s Balyasny Asset Management, Greg Eisner’s Engineers Gate Manager, and Michael Gelband’s ExodusPoint Capital.

Let’s go over hedge fund activity in other stocks similar to Meritor Inc (NYSE:MTOR). These stocks are Abercrombie & Fitch Co. (NYSE:ANF), Compass Minerals International, Inc. (NYSE:CMP), Canoo Inc. (NASDAQ:GOEV), Arbor Realty Trust, Inc. (NYSE:ABR), Dillard’s, Inc. (NYSE:DDS), Quanterix Corporation (NASDAQ:QTRX), and Axsome Therapeutics, Inc. (NASDAQ:AXSM). All of these stocks’ market caps are closest to MTOR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ANF | 20 | 412531 | -8 |

| CMP | 8 | 10647 | -2 |

| GOEV | 16 | 14846 | -1 |

| ABR | 21 | 103593 | 7 |

| DDS | 13 | 11676 | -2 |

| QTRX | 19 | 177897 | 0 |

| AXSM | 17 | 354033 | -5 |

| Average | 16.3 | 155032 | -1.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.3 hedge funds with bullish positions and the average amount invested in these stocks was $155 million. That figure was $141 million in MTOR’s case. Arbor Realty Trust, Inc. (NYSE:ABR) is the most popular stock in this table. On the other hand Compass Minerals International, Inc. (NYSE:CMP) is the least popular one with only 8 bullish hedge fund positions. Meritor Inc (NYSE:MTOR) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for MTOR is 81.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 23.8% in 2021 through July 16th and beat the market again by 7.7 percentage points. Unfortunately MTOR wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on MTOR were disappointed as the stock returned -21.4% since the end of March (through 7/16) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Meritor Inc. (NYSE:MTOR)

Follow Meritor Inc. (NYSE:MTOR)

Receive real-time insider trading and news alerts

Suggested Articles:

- 25 Best Heist Movies of All Time

- 11 Easiest Countries To Adopt A Baby

- 15 Largest Electronics Companies in the World

Disclosure: None. This article was originally published at Insider Monkey.