Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 5.7% in the 12 months ending October 26 (including dividend payments). Conversely, hedge funds’ 30 preferred S&P 500 stocks (as of June 2014) generated a return of 15.1% during the same 12-month period, with 53% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Manpowergroup Inc (NYSE:MAN).

Manpowergroup Inc (NYSE:MAN) investors should be aware of a decrease in support from the world’s most elite money managers of late. Our calculations also showed that MAN isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a lot of indicators stock market investors have at their disposal to assess stocks. A pair of the most underrated indicators are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the elite money managers can outpace their index-focused peers by a healthy amount (see the details here).

Cliff Asness of AQR Capital Management

We’re going to check out the recent hedge fund action encompassing Manpowergroup Inc (NYSE:MAN).

How have hedgies been trading Manpowergroup Inc (NYSE:MAN)?

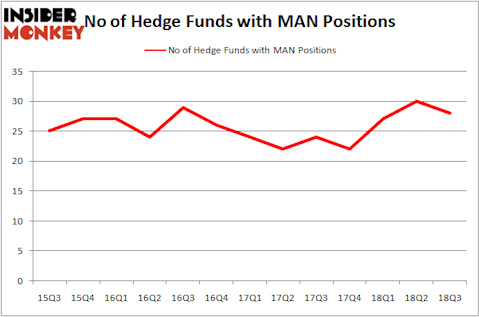

At the end of the third quarter, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of -7% from the second quarter of 2018. On the other hand, there were a total of 22 hedge funds with a bullish position in MAN at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

The largest stake in Manpowergroup Inc (NYSE:MAN) was held by AQR Capital Management, which reported holding $114.1 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $93.8 million position. Other investors bullish on the company included Two Sigma Advisors, D E Shaw, and Millennium Management.

Seeing as Manpowergroup Inc (NYSE:MAN) has experienced a decline in interest from the entirety of the hedge funds we track, it’s easy to see that there was a specific group of hedge funds who were dropping their full holdings in the third quarter. It’s worth mentioning that Steve Cohen’s Point72 Asset Management said goodbye to the biggest investment of the 700 funds followed by Insider Monkey, comprising about $38.7 million in stock. David Costen Haley’s fund, HBK Investments, also said goodbye to its stock, about $9.5 million worth. These moves are interesting, as total hedge fund interest was cut by 2 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Manpowergroup Inc (NYSE:MAN) but similarly valued. These stocks are United Therapeutics Corporation (NASDAQ:UTHR), GCI Liberty, Inc. (NASDAQ:GLIBA), Envision Healthcare Holdings Inc (NYSE:EVHC), and PLDT Inc. (NYSE:PHI). This group of stocks’ market valuations are closest to MAN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UTHR | 18 | 1006633 | -3 |

| GLIBA | 36 | 1640542 | 0 |

| EVHC | 35 | 1409277 | -3 |

| PHI | 3 | 70426 | 1 |

| Average | 23 | 1031720 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $1032 million. That figure was $592 million in MAN’s case. GCI Liberty, Inc. (NASDAQ:GLIBA) is the most popular stock in this table. On the other hand PLDT Inc. (NYSE:PHI) is the least popular one with only 3 bullish hedge fund positions. Manpowergroup Inc (NYSE:MAN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard GLIBA might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.