The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Ladder Capital Corp (NYSE:LADR) .

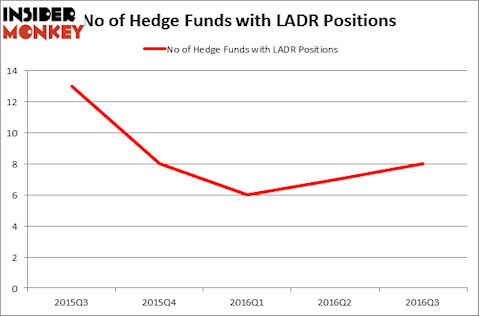

Ladder Capital Corp (NYSE:LADR) investors should be aware of an increase in hedge fund interest recently. There were 7 hedge funds in our database with LADR positions at the end of the previous quarter. At the end of this article we will also compare LADR to other stocks including Neustar Inc (NYSE:NSR), Time Inc (NYSE:TIME), and Globant SA (NYSE:GLOB) to get a better sense of its popularity.

Follow Ladder Capital Corp (NYSE:LADR)

Follow Ladder Capital Corp (NYSE:LADR)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Aleksandr Bagri/Shutterstock.com

Now, we’re going to take a look at the fresh action regarding Ladder Capital Corp (NYSE:LADR).

Hedge fund activity in Ladder Capital Corp (NYSE:LADR)

At Q3’s end, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of 14% from the previous quarter. By comparison, 8 hedge funds held shares or bullish call options in LADR heading into this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Glenhill Advisors, led by Glenn J. Krevlin, holds the most valuable position in Ladder Capital Corp (NYSE:LADR). Glenhill Advisors has a $43.9 million position in the stock, comprising 2.6% of its 13F portfolio. The second largest stake is held by Clough Capital Partners, led by Charles Clough, which holds a $10 million position; 0.5% of its 13F portfolio is allocated to the company. Some other peers with similar optimism consist of Bruce J. Richards and Louis Hanover’s Marathon Asset Management,one of the biggest hedge funds in the world, D E Shaw and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.