At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Hilltop Holdings Inc. (NYSE:HTH) has seen an increase in hedge fund sentiment lately. Our calculations also showed that hth isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are several methods market participants can use to size up publicly traded companies. Two of the most underrated methods are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the top fund managers can outclass the S&P 500 by a superb margin (see the details here).

Let’s check out the new hedge fund action encompassing Hilltop Holdings Inc. (NYSE:HTH).

Hedge fund activity in Hilltop Holdings Inc. (NYSE:HTH)

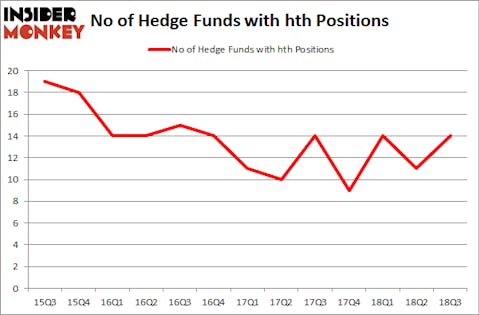

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 27% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards HTH over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Hilltop Holdings Inc. (NYSE:HTH) was held by Millennium Management, which reported holding $38.8 million worth of stock at the end of September. It was followed by Basswood Capital with a $37.1 million position. Other investors bullish on the company included GLG Partners, Royce & Associates, and D E Shaw.

As one would reasonably expect, specific money managers have jumped into Hilltop Holdings Inc. (NYSE:HTH) headfirst. Castine Capital Management, managed by Paul Magidson, Jonathan Cohen. And Ostrom Enders, created the most outsized position in Hilltop Holdings Inc. (NYSE:HTH). Castine Capital Management had $2.4 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also made a $2.2 million investment in the stock during the quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Hilltop Holdings Inc. (NYSE:HTH) but similarly valued. These stocks are Orion Engineered Carbons SA (NYSE:OEC), Shutterstock Inc (NYSE:SSTK), Cohen & Steers, Inc. (NYSE:CNS), and Otter Tail Corporation (NASDAQ:OTTR). This group of stocks’ market values are closest to HTH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OEC | 23 | 378483 | -1 |

| SSTK | 15 | 102385 | -3 |

| CNS | 9 | 60381 | 1 |

| OTTR | 9 | 68334 | -1 |

| Average | 14 | 152396 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $152 million. That figure was $136 million in HTH’s case. Orion Engineered Carbons SA (NYSE:OEC) is the most popular stock in this table. On the other hand Cohen & Steers, Inc. (NYSE:CNS) is the least popular one with only 9 bullish hedge fund positions. Hilltop Holdings Inc. (NYSE:HTH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard OEC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.