We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Hibbett Sports, Inc. (NASDAQ:HIBB).

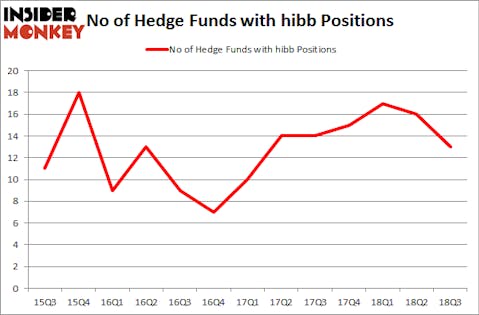

Is Hibbett Sports, Inc. (NASDAQ:HIBB) ready to rally soon? Hedge funds are getting less optimistic. The number of long hedge fund bets went down by 3 lately. Our calculations also showed that hibb isn’t among the 30 most popular stocks among hedge funds. HIBB was in 13 hedge funds’ portfolios at the end of September. There were 16 hedge funds in our database with HIBB holdings at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the fresh hedge fund action encompassing Hibbett Sports, Inc. (NASDAQ:HIBB).

Hedge fund activity in Hibbett Sports, Inc. (NASDAQ:HIBB)

At the end of the third quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -19% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards HIBB over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in Hibbett Sports, Inc. (NASDAQ:HIBB), which was worth $9.4 million at the end of the third quarter. On the second spot was D E Shaw which amassed $7.5 million worth of shares. Moreover, Arrowstreet Capital, Renaissance Technologies, and GLG Partners were also bullish on Hibbett Sports, Inc. (NASDAQ:HIBB), allocating a large percentage of their portfolios to this stock.

Because Hibbett Sports, Inc. (NASDAQ:HIBB) has witnessed falling interest from hedge fund managers, logic holds that there was a specific group of fund managers who were dropping their full holdings last quarter. At the top of the heap, Benjamin A. Smith’s Laurion Capital Management sold off the largest investment of the 700 funds watched by Insider Monkey, comprising about $0.7 million in stock. Mike Vranos’s fund, Ellington, also dropped its stock, about $0.6 million worth. These moves are important to note, as aggregate hedge fund interest fell by 3 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Hibbett Sports, Inc. (NASDAQ:HIBB). We will take a look at Simulations Plus, Inc. (NASDAQ:SLP), Concert Pharmaceuticals Inc (NASDAQ:CNCE), Elevate Credit, Inc. (NYSE:ELVT), and Exantas Capital Corp. (NYSE:XAN). All of these stocks’ market caps are closest to HIBB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SLP | 5 | 20484 | -2 |

| CNCE | 15 | 61324 | -1 |

| ELVT | 7 | 33815 | -2 |

| XAN | 15 | 45485 | 3 |

| Average | 10.5 | 40277 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $40 million. That figure was $49 million in HIBB’s case. Concert Pharmaceuticals Inc (NASDAQ:CNCE) is the most popular stock in this table. On the other hand Simulations Plus, Inc. (NASDAQ:SLP) is the least popular one with only 5 bullish hedge fund positions. Hibbett Sports, Inc. (NASDAQ:HIBB) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CNCE might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.