The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Greenhill & Co., Inc. (NYSE:GHL).

Is Greenhill & Co., Inc. (NYSE:GHL) the right investment to pursue these days? The smart money is buying. The number of long hedge fund positions inched up by 2 recently. Our calculations also showed that GHL isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most stock holders, hedge funds are assumed to be worthless, old financial tools of yesteryear. While there are greater than 8,000 funds with their doors open at present, Our experts choose to focus on the upper echelon of this club, approximately 700 funds. These hedge fund managers preside over the majority of the smart money’s total capital, and by tailing their highest performing stock picks, Insider Monkey has come up with several investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s review the recent hedge fund action regarding Greenhill & Co., Inc. (NYSE:GHL).

What have hedge funds been doing with Greenhill & Co., Inc. (NYSE:GHL)?

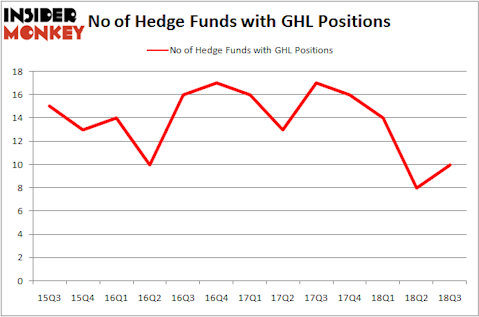

Heading into the fourth quarter of 2018, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GHL over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Greenhill & Co., Inc. (NYSE:GHL) was held by Fisher Asset Management, which reported holding $17.1 million worth of stock at the end of September. It was followed by Rutabaga Capital Management with a $10.2 million position. Other investors bullish on the company included Ancora Advisors, Millennium Management, and Intrepid Capital Management.

With a general bullishness amongst the heavyweights, key hedge funds were breaking ground themselves. Millennium Management, managed by Israel Englander, created the most valuable position in Greenhill & Co., Inc. (NYSE:GHL). Millennium Management had $4.5 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also made a $0.9 million investment in the stock during the quarter. The following funds were also among the new GHL investors: Jim Simons’s Renaissance Technologies and Alec Litowitz and Ross Laser’s Magnetar Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Greenhill & Co., Inc. (NYSE:GHL) but similarly valued. We will take a look at The Hackett Group, Inc. (NASDAQ:HCKT), Dova Pharmaceuticals, Inc. (NASDAQ:DOVA), B. Riley Financial, Inc. (NASDAQ:RILY), and Nuveen Floating Rate Income Fund (NYSE:JFR). All of these stocks’ market caps are similar to GHL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HCKT | 10 | 79253 | -2 |

| DOVA | 4 | 88619 | -2 |

| RILY | 9 | 107488 | -1 |

| JFR | 2 | 344 | -3 |

| Average | 6.25 | 68926 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.25 hedge funds with bullish positions and the average amount invested in these stocks was $69 million. That figure was $51 million in GHL’s case. The Hackett Group, Inc. (NASDAQ:HCKT) is the most popular stock in this table. On the other hand Nuveen Floating Rate Income Fund (NYSE:JFR) is the least popular one with only 2 bullish hedge fund positions. Greenhill & Co., Inc. (NYSE:GHL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HCKT might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.