Before we spend many hours researching a company, we’d like to analyze what hedge funds and billionaire investors think of the stock first. We would like to do so because the successful investors’ consensus returns have been exceptional. The top 30 mid-cap stocks among the best performing hedge funds in our database yielded an average return of 18% during the last 12 months, outperforming the S&P 500 Index funds by double digits. Although the successful funds occasionally have their duds, such as SunEdison and Valeant, the hedge fund picks seem to work on average. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Enel Americas SA (ADR) (NYSE:ENIA).

Is Enel Americas SA (ADR) (NYSE:ENIA) ready to rally soon? The smart money is definitely getting less optimistic. The number of long hedge fund positions fell by 2 recently. There were 12 hedge funds in our database with ENIA holdings at the end of the third quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Broadridge Financial Solutions, Inc. (NYSE:BR), Crown Holdings, Inc. (NYSE:CCK), and Pearson PLC (ADR) (NYSE:PSO) to gather more data points.

Follow E N I Spa (NYSE:E)

Follow E N I Spa (NYSE:E)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

chungking/Shutterstock.com

Keeping this in mind, we’re going to take a gander at the new action regarding Enel Americas SA (ADR) (NYSE:ENIA).

What does the smart money think about Enel Americas SA (ADR) (NYSE:ENIA)?

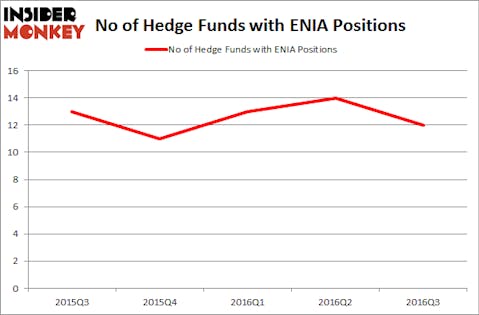

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a decline of 14% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ENIA over the last 5 quarters. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, AQR Capital Management, led by Cliff Asness, holds the largest position in Enel Americas SA (ADR) (NYSE:ENIA). According to regulatory filings, the fund has a $16.8 million position in the stock, comprising less than 0.1% of its 13F portfolio. The second most bullish fund manager is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holding a $14.4 million position; less than 0.1% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that are bullish contain Renaissance Technologies, one of the largest hedge funds in the world, Joseph Oughourlian’s Amber Capital and Dmitry Balyasny’s Balyasny Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.