You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

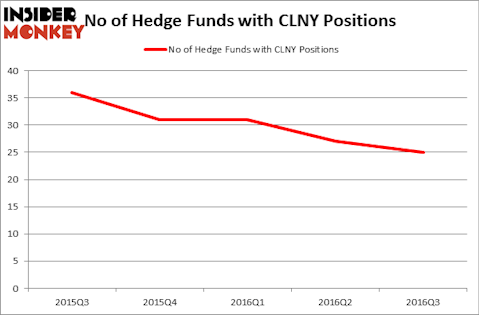

Is Colony Capital Inc (NYSE:CLNY) undervalued? Hedge funds are categorically taking a bearish view. The number of long hedge fund investments shrunk by 2 in recent months. CLNY was in 25 hedge funds’ portfolios at the end of the third quarter of 2016. There were 27 hedge funds in our database with CLNY holdings at the end of the previous quarter. At the end of this article we will also compare CLNY to other stocks including Chemtura Corp (NYSE:CHMT), CBL & Associates Properties, Inc. (NYSE:CBL), and Oasis Petroleum Inc. (NYSE:OAS) to get a better sense of its popularity.

Follow Colony Capital Inc. (NYSE:CLNY)

Follow Colony Capital Inc. (NYSE:CLNY)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Aleksandr Bagri/Shutterstock.com

What have hedge funds been doing with CLNY?

At the end of the third quarter, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a fall of 7% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CLNY over the last 5 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Seth Klarman’s Baupost Group has the largest position in CLNY, worth close to $81 million, corresponding to 1.2% of its total 13F portfolio. On Baupost Group’s heels is Diamond Hill Capital, led by Ric Dillon, which holds a $41.8 million position. Some other members of the smart money that hold long positions contain Wayne Cooperman’s Cobalt Capital Management, Brett Barakett’s Tremblant Capital and Israel Englander’s Millennium Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.