There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Cerus Corporation (NASDAQ:CERS) .

Hedge fund interest in Cerus Corporation (NASDAQ:CERS) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Thermon Group Holdings Inc (NYSE:THR), Eastman Kodak Co. (NYSE:KODK), and Winnebago Industries, Inc. (NYSE:WGO) to gather more data points.

Follow Cerus Corp (NASDAQ:CERS)

Follow Cerus Corp (NASDAQ:CERS)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Elena Pavlovich/Shutterstock.com

With all of this in mind, we’re going to take a look at the key action regarding Cerus Corporation (NASDAQ:CERS).

How have hedgies been trading Cerus Corporation (NASDAQ:CERS)?

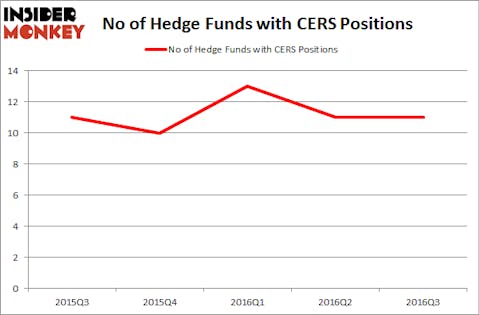

Heading into the fourth quarter of 2016, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the second quarter of 2016. By comparison, 10 hedge funds held shares or bullish call options in CERS heading into this year. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Julian Baker and Felix Baker’s Baker Bros. Advisors has the most valuable position in Cerus Corporation (NASDAQ:CERS), worth close to $81.1 million, accounting for 0.7% of its total 13F portfolio. The second largest stake is held by Richard Mashaal of Rima Senvest Management, with a $15 million position; the fund has 1.1% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that are bullish include Richard Driehaus’s Driehaus Capital, Chuck Royce’s Royce & Associates and John Croghan and Richard Fradin’s Rail-Splitter Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Due to the fact that Cerus Corporation (NASDAQ:CERS) has encountered declining sentiment from the aggregate hedge fund industry, it’s easy to see that there was a specific group of fund managers who sold off their entire stakes heading into Q4. Intriguingly, Israel Englander’s Millennium Management, one of the 10 largest hedge funds in the world, got rid of the biggest stake of all the investors monitored by Insider Monkey, totaling about $0.4 million in stock. Jim Simons’ fund, Renaissance Technologies, also dropped its stock, about $0.1 million worth.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Cerus Corporation (NASDAQ:CERS) but similarly valued. These stocks are Thermon Group Holdings Inc (NYSE:THR), Eastman Kodak Co. (NYSE:KODK), Winnebago Industries, Inc. (NYSE:WGO), and Aimmune Therapeutics Inc (NASDAQ:AIMT). This group of stocks’ market caps are similar to CERS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| THR | 4 | 13804 | -2 |

| KODK | 14 | 155395 | 3 |

| WGO | 14 | 88664 | 1 |

| AIMT | 9 | 102623 | -2 |

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $90 million. That figure was $108 million in CERS’s case. Eastman Kodak Co. (NYSE:KODK) is the most popular stock in this table. On the other hand Thermon Group Holdings Inc (NYSE:THR) is the least popular one with only 4 bullish hedge fund positions. Cerus Corporation (NASDAQ:CERS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard KODK might be a better candidate to consider taking a long position in.