The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 823 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of June 30th, when the S&P 500 Index was trading around the 3100 level. Stocks kept going up since then. In this article we look at how hedge funds traded West Pharmaceutical Services Inc. (NYSE:WST) and determine whether the smart money was really smart about this stock.

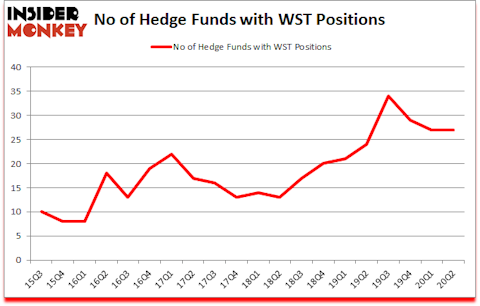

West Pharmaceutical Services Inc. (NYSE:WST) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 27 hedge funds’ portfolios at the end of the second quarter of 2020. Our calculations also showed that WST isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). At the end of this article we will also compare WST to other stocks including Smith & Nephew plc (NYSE:SNN), China Unicom (Hong Kong) Limited (NYSE:CHU), and CDW Corporation (NASDAQ:CDW) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 56 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, legal marijuana is one of the fastest growing industries right now, so we are checking out stock pitches like “the Starbucks of cannabis” to identify the next tenbagger. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind we’re going to take a peek at the latest hedge fund action encompassing West Pharmaceutical Services Inc. (NYSE:WST).

Hedge fund activity in West Pharmaceutical Services Inc. (NYSE:WST)

At Q2’s end, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. By comparison, 24 hedge funds held shares or bullish call options in WST a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in West Pharmaceutical Services Inc. (NYSE:WST) was held by Fisher Asset Management, which reported holding $97.1 million worth of stock at the end of September. It was followed by Intermede Investment Partners with a $49.1 million position. Other investors bullish on the company included Millennium Management, Citadel Investment Group, and AQR Capital Management. In terms of the portfolio weights assigned to each position Intermede Investment Partners allocated the biggest weight to West Pharmaceutical Services Inc. (NYSE:WST), around 2.4% of its 13F portfolio. Sandler Capital Management is also relatively very bullish on the stock, setting aside 1.87 percent of its 13F equity portfolio to WST.

Judging by the fact that West Pharmaceutical Services Inc. (NYSE:WST) has experienced declining sentiment from the smart money, it’s safe to say that there were a few hedgies that elected to cut their entire stakes in the second quarter. Intriguingly, Robert Joseph Caruso’s Select Equity Group cut the largest position of the “upper crust” of funds tracked by Insider Monkey, comprising an estimated $14.7 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also cut its stock, about $1.7 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to West Pharmaceutical Services Inc. (NYSE:WST). These stocks are Smith & Nephew plc (NYSE:SNN), China Unicom (Hong Kong) Limited (NYSE:CHU), CDW Corporation (NASDAQ:CDW), TransUnion (NYSE:TRU), Northern Trust Corporation (NASDAQ:NTRS), Restaurant Brands International Inc (NYSE:QSR), and Yandex NV (NASDAQ:YNDX). This group of stocks’ market valuations are similar to WST’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SNN | 12 | 90551 | 3 |

| CHU | 8 | 42706 | 2 |

| CDW | 40 | 1179993 | 4 |

| TRU | 47 | 1628502 | 3 |

| NTRS | 35 | 449745 | 8 |

| QSR | 44 | 2868475 | 3 |

| YNDX | 44 | 1403652 | 9 |

| Average | 32.9 | 1094803 | 4.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.9 hedge funds with bullish positions and the average amount invested in these stocks was $1095 million. That figure was $379 million in WST’s case. TransUnion (NYSE:TRU) is the most popular stock in this table. On the other hand China Unicom (Hong Kong) Limited (NYSE:CHU) is the least popular one with only 8 bullish hedge fund positions. West Pharmaceutical Services Inc. (NYSE:WST) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for WST is 53.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 21.3% in 2020 through September 25th and still beat the market by 17.7 percentage points. A small number of hedge funds were also right about betting on WST as the stock returned 18.7% since the end of June (through September 25th) and outperformed the market by an even larger margin.

Follow West Pharmaceutical Services Inc (NYSE:WST)

Follow West Pharmaceutical Services Inc (NYSE:WST)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.