Walgreens Boots Alliance Inc (NASDAQ:WBA) has experienced decades of growth by providing customers with a convenient location for medicine and grocery products.

The company was founded in 1901 in Chicago, Illinois. Walgreens acquired Alliance Boots outright on December 31st, 2014. The transformative move gave Walgreens a large international presence.

The company decided to not relocate its headquarters internationally when it acquired Alliance Boots. Relocating would have made Walgreens Boots Alliance an additional $4 billion in after tax profits over 5 years. The company did not relocate due to political pressure from the United States government.

Walgreens Boots Alliance also enjoys a strong support from smart money investors. Among some 730 hedge funds and institutional investors followed by Insider Monkey, 91 reported long positions in Walgreens Boots Alliance, which makes it one of the most popular drug store stock among the funds tracked by Insider Monkey. Moreover, during the third quarter of 2015, the number of funds with long positions in the stock surged by 10, while the total value of their holdings amounted to $9.51 billion at the end of September, representing 10.50% of the company’s stock.

Walgreens Boots Alliance currently has a market cap of $87 billion. The company is the second largest publicly traded drug store. CVS Health Corp (NYSE:CVS) is larger. CVS Health’s market cap of $104 billion is about 20% larger than Walgreens Boots Alliance’s market cap.

Dividend Analysis

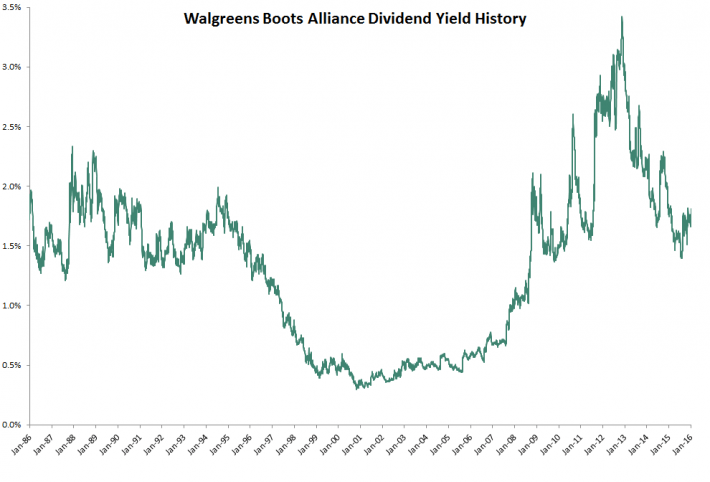

Walgreens Boots Alliance has increased its dividend payments for 40 consecutive years. The company’s reliable dividend growth history over the last several decades is shown in the image below:

Walgreens Boots Alliance has grown its dividend payments at a compound rate of 18.5% a year over the last decade.

This rapid rate of dividend growth is (unfortunately) unsustainable for Walgreens Boots Alliance. Over the long run, the company will only be able to increase its dividends in line with earnings-per-share growth (which is discussed in the Growth Prospects section of this article).

The company’s stock currently offers investors a dividend yield of 1.8%. This is 0.4 percentage points lower than the S&P 500’s current dividend yield of 2.2%.

Walgreens Boots Alliance historical average dividend yield since 1985 is just 1.3%. This is a bit misleading, as the company has hiked its payout ratio over the last decade. Walgreens Boots Alliance’s average dividend yield since the beginning of 2007 is 1.8% – in line with the company’s current dividend yield.

The image above shows that Walgreens Boots Alliance’s dividend yield peaked around the beginning of 2013 at 3.4%.

Follow Walgreens Boots Alliance Inc. (NASDAQ:WBA)

Follow Walgreens Boots Alliance Inc. (NASDAQ:WBA)

Receive real-time insider trading and news alerts

Business Overview

Walgreens Boots Alliance Inc (NASDAQ:WBA) has locations in 25+ countries and employees 370,000 people. The global pharmacy giant’s vision is to:

“Be the first choice for pharmacy, well-being and beauty – caring for people and communities around the world”

Walgreens Boots Alliance’ management have actively reshaped the business through several deals and acquisitions over the last several years…

In 2013 Walgreens Boots Alliance entered into a strategic agreement with drug wholesaler AmerisourceBergen Corp. (NYSE:ABC). The deal aligns the interests of both companies. The alliance is a net positive for Walgreens Boots Alliance as it closely allies the company the second largest generic drug wholesaler in the US.

Walgreens other strategic maneuver was to acquire a 45% stake in Alliance Boots in 2012. The company acquired 100% of Alliance Boots at the end of 2014.

Alliance Boots was a drug store chain based in Switzerland. The majority of the company’s operations were in the United Kingdom and Ireland. The drug store chain had a presence throughout much of Europe, as well as Thailand. Alliance Boots also manufactured and sold the No. 7 line of beauty products, among others.

Walgreens Boots Alliance is not done with its acquisitions. The company has entered into an agreement with Rite Aid (RAD) for $17.2 billion in cash and debt. The deal is expected to close in the second half of 2016.

Competitive Advantage

Walgreens Boots Alliances’ competitive advantage comes from its scale global scale and convenient store locations throughout the United States and Europe.

The company’s small store layouts (compared to grocery stores and big box stores) and locations on the corners of intersections (hence the ‘corner store’ name) make shopping fast, easy, and convenient.

Prescription medicine refills help drive traffic to the company’s stores. Customers who need to refill prescription medication on a regular basis present an opportunity for both recurring prescription revenue and additional sales if the customer enters into the store to fill his/her prescription.

Growth Prospects & Total Return Potential

While Walgreens Boots Alliance management has been very active with its acquisitions, there are concerns the company is engaging in ‘empire building’ rather than seeking to maximize shareholder value.

As mentioned above, Walgreens Boots Alliance failed to capitalize on potential tax savings by not going through with its tax inversion plan when acquiring Alliance Boots. The company caved in to political pressure rather than seeking to maximize shareholder value through the tax inversion.

The (in my opinion) weak rational for not doing the tax inversion is that there would be significant backlash from United States consumers if the company did a tax inversion. I find it difficult to believe that the great majority of United States citizens care that strongly about international tax issues on multinational corporations. For most consumers, the decision of where to shop is based on convenience, price, and habit – not tax consequences of the corporation.

Walgreens Boots Alliance recently announced that it is suspending its share repurchase activity in order to fund the Rite Aid acquisition. Walgreens Boots Alliance is acquiring Rite Aid for a 48% premium to the company’s pre-acquisition share price. This comes to a price-to-earnings acquisition of around 30 – far from a value play. It appears that Walgreens Boots Alliance is significantly overpaying for Rite Aid. Acquisitions done at unattractive prices destroy shareholder value.

In spite of these concerns, Walgreens Boots Alliance is experiencing promising growth. The company saw adjusted earnings-per-share surge 32.1% in its most recent quarter. In total, the company is expecting earnings-per-share of $4.30 to $4.55 in fiscal 2016. This gives Walgreens Boots Alliance a forward price-to-earnings ratio of 17.8 to 18.8.

Walgreens Boots Alliance is expecting low double-digit earnings-per-share growth over the next several years. This is excellent growth for a large corporation. The company plans to achieve this growth through synergies from the Rite Aid acquisition, cost cutting, and continued organic growth in Walgreens pharmacies.

Over the long-term, Walgreens Boots Alliances’ growth will come from rising prescription use as the global population ages, especially in the developed world where Walgreens has the largest presence. The company stands to benefit from both an aging population in Europe and the US brought about by the “baby boomer” population bulge, and from rising prescription drug use and greater health care coverage and usage in general.

Over the last decade, Walgreens Boots Alliance has managed to grow earnings-per-share at 9.5% a year. The company should continue growing earnings-per-share at 8% to 12% a year over the next several years.

This growth combined with the company’s current 1.8% dividend yield gives investors expected total returns of ~10% to ~12% a year before changes in the company’s valuation.

Valuation

Walgreens Boots Alliance is trading for a forward price-to-earnings multiple of around 18.3. The company has double-digit expected total returns. For comparison, the S&P 500’s forward price-to-earnings multiple is 15.8.

The company is trading in line with its historical average dividend yield since 2007.

Based on these facts, I believe Walgreens Boots Alliance is trading around fair value at current prices given its above-average total return prospects and strong competitive advantage.

Recession Performance

Walgreens Boots Alliance has historically performed well through recessions. The company’s prescription refill driven store traffic flows in regardless of the overall economy. People need their prescriptions refilled no matter what is happening in the stock market.

Walgreens Boots Alliance’s earnings-per-share through the Great Recession of 2007 to 2009 are shown below to illustrate the company’s recession resistance.

– 2007 Earnings-per-share of $2.03 (new high)

– 2008 Earnings-per-share of $2.17 (new high)

– 2009 Earnings-per-share of $2.02 (recession low)

– 2010 Earnings-per-share of $2.16 (partial recovery)

– 2011 Earnings-per-share of $2.64 (new high)

Final Thoughts

Walgreens Boots Alliance Inc (NASDAQ:WBA) ranks in the Top 60 based on the 8 Rules of Dividend Investing due to its above-average growth rate and expected total returns, combined with a slightly below average stock price standard deviation of 27.3%.

Walgreens Boots Alliance is benefiting from favorable long-term trends in the health care industry. I believe there are better choices in the health care sector today, but there is no doubt that Walgreens Boots Alliance is a high quality dividend growth stock with a long growth runway ahead.

Observant shareholders should watch the company’s management as their acquisition-fueled growth could run counter to shareholder interests. For now, the company’s acquisitions have been accretive to shareholder value.

Disclosure: None